Every gram of gold approaches 720 yuan’s hoarders, who are busy cashing in gold.

"It’s gone up again!" The price of pure gold jewelry has been soaring, and now it is approaching the 720 yuan/gram mark, and its fierce rise has made many consumers call it "incomprehensible". Gold, which is rising by one price a day, is "persuading" consumers.

On April 6th, the topic "Big hoarders are busy realizing gold" rushed to Weibo for hot search, which aroused widespread concern.

One price one day

Large hoarders of gold have realized in succession.

International gold prices soared again on Friday, with spot gold prices rising 1.5% to $2,324.15 per ounce, hitting a record high of $2,330.06 in intraday trading.

Although the data released on the same day showed that the non-farm employment growth in the United States was strong in March, which further cooled the market’s bet on the probability of the Fed’s interest rate cut in June, the price of gold obviously did not suffer too much negative impact. After a short correction, it rose all the way, and it stood at the $2,300 mark for the first time in history.

In the past 10 days, the price of gold has risen in 9 days, and it has risen in 6 weeks in the past 7 weeks.

Gold prices have soared in the international market, and domestic basic gold prices have also reached a high level. The retail price of many domestic brands of gold jewelry is also close to 720 yuan per gram.

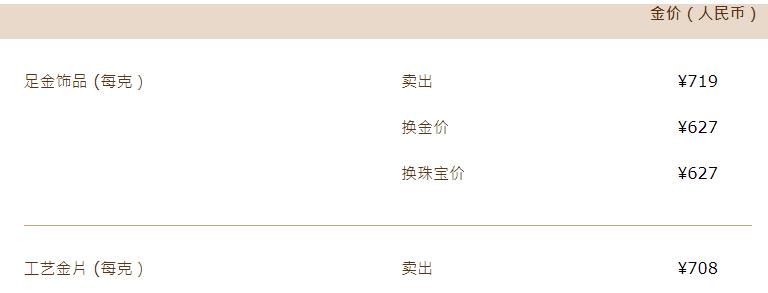

On April 7th, the retail listing price of gold jewelry in Zhou Shengsheng has soared to 719 yuan/gram, while Chow Tai Fook and Chaohongji were 718 yuan/gram and 718 yuan/gram respectively, both of which increased by 15 yuan compared with 703 yuan/gram on the 3rd.

According to CCTV financial report, many gold jewelry wholesalers have gathered in Zhaoyuan, Shandong recently. In terminal stores, buyers are particularly cautious about buying gold jewelry. In terms of choosing styles, buyers have changed their choice from traditional crafts to fashionable jewelry with national tide culture as the element. In some offline gold jewelry stores, enameled gold jewelry with exquisite craftsmanship and colorful colors has also won the favor of consumers.

With the rising price of gold, the repurchase of offline large quantities of gold raw materials has become the "highlight", and many "big hoarders" have chosen to sell at the high price of gold. While the online repurchase of gold raw materials is hot, many gold shops have also opened online repurchase models.

The person in charge of an online gold repurchase business said, "We allow consumers to realize the rapid realization of gold by means of subsidizing the issuance of coupons, free mailing, and preferential handling fees, among which the maximum online gold recovery in a single day reached more than 3,000 grams."

According to the first financial report, consumers’ enthusiasm for buying gold has declined recently. During the Qingming small holiday, the brand gold shops in several shopping malls in Shanghai only had customers in twos and threes, and some gold ornaments counters were also empty. After the inquiry, only a few consumers who were looking at accessories in the store said that the price was too high, "It’s too boring to buy now."

The "buying gold fever" continued, and some bank gold bars were out of stock. According to Red Star News, on April 4th, the staff of Chunxi Road Pedestrian Street Sub-branch of Industrial and Commercial Bank of China said that the shortage of gold bars had been going on for about a month, and now it was necessary to make an appointment to buy them.

Gold recycling enthusiasm is high.

Investment should not blindly follow suit

Gold investment has always been regarded as a relatively stable way of wealth appreciation. The huge fluctuation of the price of gold has also led to a rise in the volume and price of gold recovery. According to Chengdu Daily, a gold shop clerk said that after this round of price increase, the consulting volume and recycling volume increased significantly, and many investors hoped to cash in when the price of gold rose.

However, compared with the soaring price of gold ornaments, the price difference of gold recycling is large. Take Chow Tai Fook as an example. At present, the gold recovery price is 524 yuan/gram, which is 194 yuan per gram compared with the price of 718 yuan/gram. Even according to the discounted price, there is a price difference of 145 yuan per gram. If a customer buys a 50-gram bracelet and chooses to sell it, it will lose more than 7000 yuan.

According to industry insiders, for ordinary consumers, gold jewelry consumption and gold investment are completely different.

Investors should first understand the price of gold. Generally speaking, the listed gold price of a gold shop can be divided into jewelry gold, investment gold and recovery gold. Different brands have different gram prices of jewelry gold, but jewelry gold is often the highest gram price. The price of investment gold bars is relatively low. If you want to invest in gold, you need to have basic relevant knowledge and fully understand the precious metal market before you can enter the market.

Therefore, although gold consumption is hot, it is not advisable to blindly hoard goods and follow the trend of "buying gold".

For the market outlook, the China Gold Association said that the resilience of gold prices reflects to some extent investors’ expectations that the Fed will eventually cut interest rates this year. In addition, the increasing geopolitical uncertainty has also enhanced the attractiveness of gold as a safe-haven asset. Finally, the steady buying of gold by global official departments so far this year has provided solid support for the reserve price of gold. "After entering the second half of 2024, once the Fed starts to cut interest rates and releases the signal that it will further accelerate the pace of monetary easing in 2025, the price of gold is expected to regain its upward trend." China Gold Association said.

Original title: skyrocketing! Every gram approaches 720 yuan, and the "big family" is busy realizing it.