Hengda Automobile Announcement: The divestiture of real estate business has suspended production due to lack of funds.

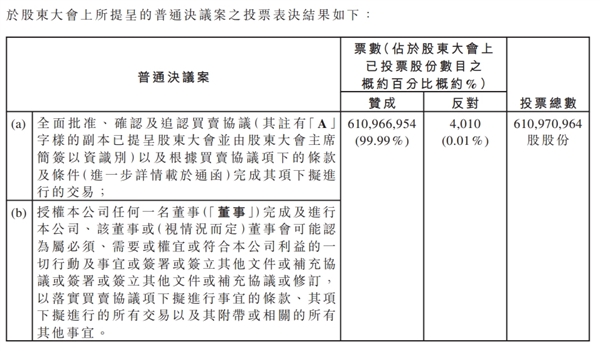

Fast technology on May 13 news, this morning Hengchi official account announced that Hengda Automobile has announced that the shareholders meeting agreed to sell 47 real estate projects to China Hengda and its subsidiaries.

This means that Evergrande has completed the divestiture of its real estate business and become a pure new energy vehicle company.

According to the official, Hengda Automobile divested its real estate business, concentrated resources to ensure Hengchi’s research and development and production, and focused on the new energy vehicle track, which will help to improve market valuation and win the favor of capital, which is conducive to the development of Hengchi Automobile.

It is reported that China Evergrande announced on April 24 that the buyer (Anxin Holdings Co., Ltd., a wholly-owned subsidiary of the company) and the company entered into a sale and purchase agreement with Hengda Automobile, under which the buyer conditionally agreed to purchase and Hengda Automobile conditionally agreed to sell the target shares as beneficial owners, including 21 Hengda Health Valley projects, 5 Hengda Health City projects and 21 property development projects. The initial consideration of Hengda Automobile’s target shares is RMB 2.

At the same time, Hengda Motor mentioned in the announcement that due to lack of funds, its Tianjin factory has suspended production of Hengchi 5 and plans to resume production in May, but has not yet resumed production.

It is reported that Hengda Automobile released six models of Hengchi at the same time during the 2020 Shanghai Auto Show, including Hengchi 1, Hengchi 2, Hengchi 3, Hengchi 4, Hengchi 5, and Hengchi 6, covering passenger car models such as sedans, coupes, SUVs, MPVs, and crossovers.

This is also a highlight moment for Hengda Automobile, but shortly thereafter, Hengda Automobile has turned from prosperity to decline. As the market value of Hengda Automobile plummeted at a high level in early 2021, the share price has plummeted from a peak of 72 Hong Kong dollars to 3.2 Hong Kong dollars today.