NIO: Reflection is more important than selling cars

NIO released the 2023 Quarter 1 financial report Long Bridge US stocks premarket on June 9, Beijing time. Another large area of "spicy eye" performance, if the fourth quarter of last year is poor, the first quarter of this year is still a "strengthened version":

1. Poor sales and poor income:$NIO – SW.HK revenue 10.70 billion, and less than the market expectations, the 1 billion +, the sales difference is known, the key is because of the volume price, the old car, 75kwh entry models accounted for more, resulting in a unit price of only 297,000, significantly lower than market expectations.

2. Gross margin collapse: As the unit price fell below 300,000 for the first time, much lower than the previous guidance implied unit price of about 320,000,The gross profit margin of the car fell directly to 5% without impairment and other operations, far lower than the market expectation of about 10%. Obviously, the damage caused by the price reduction of the old model and the low gross profit margin of ET5, the capacity utilization rate in the process of platform replacement has particularly serious damage to NIO.

3. Guidance mediocre: second quarterGuidance sales 2.3 – 25,000 units, due to the known sales in April and May, implied sales in June after the release of the new ES6, finally began to stand on the 10,000, guidance implied sales in June should be about 11,000. And the company’s goal is that ET5 + ES6 double top stream can bring 20,000 monthly sales, this guidance is still significantly different from this goal.

However,$NIO. SG The price of implied bicycles behind the revenue guidance 87-9.40 billion may recover to about 320,000, the proportion of implied inventory vehicles may decrease, and the gross margin should recover.

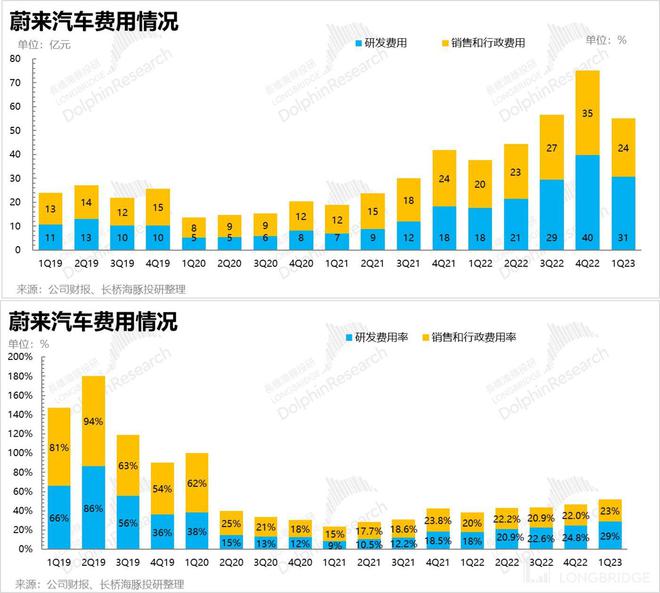

4. NIO who is still "voting":Although the gross profit has dropped to less than 20,000 yuan, NIO wants to do a lot of things in R & D and needs to "warm up users". The investment in R & D and sales expenses has not seen obvious restraint. The operating loss rate hit a three-year high, reaching 48%, significantly higher than market expectations.

Dolphin Jun’s overall perspective:

For new forces with a very short period of new car explosions and repeatedly falling into the green and yellow of changing cars, Dolphin Jun naturally has a red label of "suspicious execution". Obviously, the current NIO is such a company.

Therefore, the previous share price of 9 yuan has fallen to the PS valuation level between life and death in 2019. Dolphin Jun proposed that companies with too big dreams and too weak execution cannot talk about bottom fishing lightly. By this financial report, the company’s share price was hovering at 7-8 yuan, and bottom fishing did not generate profits.

Of course, from the perspective of marginal changes, this performance is basically the bottom of NIO’s performance: because NIO’s double-top streaming car ES6 went on sale at the end of May and the ET5 hunting version went on sale in June, two promising cars began to contribute to full sales in the second half of the year, and all other models will basically transition to the NT2.0 platform. Sales and gross profit margins are unlikely to be worse, and will only go in the direction of improvement.

In the corresponding stock price, along with the improvement of sales volume and gross profit margin, there is also hope to slowly climb out of the bottom. But how much can be pulled up from the bottom, or can it return to the previous height? It depends on how much the original new power brother reflects on this wave of mistakes, and how much the execution improves. Dolphin Jun has doubts. At least to see the change of attitude first, you might as well listen to what NIO has to say in the phone call.

First, stronger than painting cakes, weaker than landing: NIO, it’s time to reflect

Let me remind you of the two core goals of NIO’s delivery this year:

1)NIO aims to deliver 250,000 vehicles this year.

2) By the fourth quarter, the monthly sales should stand firm 30,000 vehicles: the two pillar cars ET5 + ES6 have a total monthly sales of 20,000, ET7 + ES7 + ES8 have a total contribution of 8k-10k vehicles, and the two coupe EC6 and EC7 have a total monthly sales of about 2k vehicles.

Goals vs reality, let’s compare:

1) By the end of the first half of this year, the delivery was probably on 55,000 vehicles, barely completing a little more than 20% of the annual target. In the case of just climbing 10,000 in June, it is equivalent to 32,500 monthly delivery in the second half of the year, which means that the hope of achieving the 250,000 goal for the whole year is very slim.

2) Monthly sales 30,000 target vs May 6k reality: In May, due to NIO’s two top-class models – ES6 replacement and ET5 hunting car to be released, the new ES8 was launched in June and EC6 was launched in July; the new EC7 was relatively niche, and it was just launched and basically did not contribute to sales;, in addition, the market demand for ET7 and ES7 models that are not being replaced is weak, and the final result is that NIO sold a mere 6,155 units in May, even lower than in April.

On the list of new car makers in May, the original first brother has almost slipped to the bottom.

Fortunately, looking ahead, it should be the worst time for NIO nowFrom the perspective of the release rhythm of the model, NIO’s two promising contributions to large sales ET5 and ES6:

ES6: As the best-selling SUV in the NIO model matrix, on May 24 this year, NIO released an updated version of ES 6 (competitors mainly include Model Y, L7, etc.), and deliveries began that night.

According to market survey information, within 72 hours of ES6 release, the average intention of a single store was 90 orders, 20 prepaid orders, and ES6 contributed 60-70% of the incoming traffic. Preliminary data seems to be good.

2.) ET5 prey version: released on June 15 and delivered in the same month ET5 prey version, prey version will optimize the current ET5 rear space, it is estimated that part of the original wait-and-see ET5 lead.

After the two NIO top-class models are all launched in June, the monthly sales of tens of thousands is a reasonable expectation for the market. So from this quarter, the second quarter sales guidance given by NIO 2.3-2 5,000 vehicles are only within expectations.

Due to the sales volume of 6.7k in April and 6.2k in May, this guide implies that the sales volume in June is 11,000, which is basically the same as the market expectation of 10,000 vehicles in June. There is no further shock, but it is obviously not a surprise.

Overall, NIO has not really exploded in this cycle of car replacement, from new cars such as ET5 to the present. Compared with the ideal replacement cycle, the replacement time of NT2.0 models has been delayed for too long, and the problem is still obvious.

When the automotive market had long since entered the era where demand was king, NIO wanted too much, and its execution was still stuck in the era of "supply is king", completely unable to keep up with its peers who were crazy about rolling in.

Finally, from the perspective of the actual delivery volume in the first quarter, only 31,000 vehicles were achieved, barely reaching the lower limit of the original target 3.1-3 3,000 vehicles.

Fatal Expectation Spread: Gross Margin Revisited

Behind the poor sales volume, the gross profit margin was pulled again, and the severity exceeded the one-time impairment 1 billion due to "inventory impairment provisions, accelerated depreciation of production equipment, and loss of old 866 purchase agreement" in the first quarter.

In the first quarter of this year, NIO’s gross profit margin of automobile sales was only 5.1%, while the gross profit margin of automobiles 1 billion one-time factors was 13.5% in the last quarter, while the market’s expectations for the gross profit margin of automobiles in the first quarter were basically in double digits, basically between 10% and 12%.

Specifically, consider the bicycle economy.

1) In the first quarter, bicycle revenue hit a record low, falling below 300,000 for the first time, only 297,000, and the cost of bicycles directly fell 70,000.

Of course, the reason is also obvious. During the new car replacement period, the old 866 model has exhibition car clearance, national subsidies, and financial discounts, etc.; while the unit price of the new ET5 itself is lower than that of the previous models, the gross profit margin is also low, and the average price decline is normal.

2) Now that NT1.0 is converted to NT2.0, the intermediate capacity utilization rate is very low, which will also drag down the gross profit margin; the cost of a bicycle cannot go down synchronously with the price of a single car, and the gross profit of a bicycle is further reduced by 3,000 yuan compared with the fourth quarter, and the gross profit margin is directly pulled from 6.8% to 5.1%. The standard gross profit margin for car manufacturing should be around 20%, which is too large.

Fortunately, looking ahead, NIO couldn’t be any worse.

The company’s guidance for the second quarter revenue is between 87.4 and 9.37 billion. Dolphin Jun’s estimated bicycle revenue should be about 32.5-33 million, and by the end of the second quarter, basically all NIO models have been transferred to the NT2.0 platform.

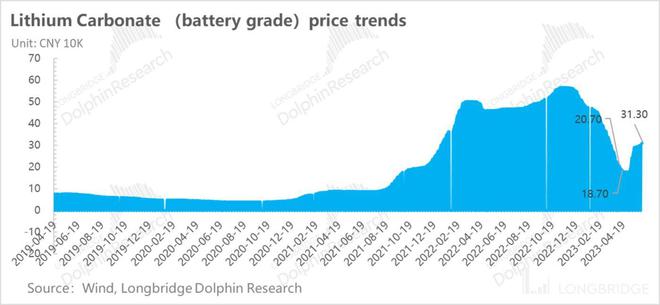

In addition, although the overall price of lithium carbonate has reached about 300,000 from the beginning of the 190,000, compared with the previous 500,000, there is still a trend to fall, and the decline in battery costs will also help NIO to ease the cost pressure.

Of course, under the brand tone of NIO’s "no price reduction", the real increase in gross profit margin still depends on whether NIO really reaches the target of 30,000 monthly sales and pulls up the capacity utilization rate. And on this point, Dolphin Jun is still skeptical:

1) In terms of the current trend, the Chinese luxury car market above 30w seems to have a relatively tenacious vitality of fuel vehicles, and the penetration rate is relatively slow. At present, it is less than 20%, which is not as good as the overall pure electric penetration rate.

2) In the absence of insufficient facilities such as fast charging/power exchange, when pure electric luxury cars further go out of first-tier cities such as Shanghai and further penetrate into the lower-tier market, it seems that there is no ideal range extension model that can better target user pain points.

Third, the income pulls the hips, the natural result of poor sales

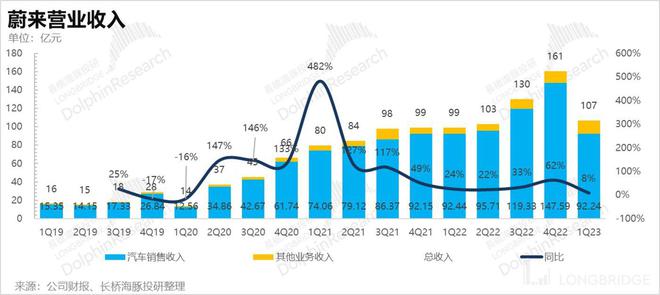

NIO’s revenue 10.70 billion in the first quarter, growing by only 8% year-on-year, significantly lower than the market consensus expectations 11.60 billion, clearing inventory and other low unit prices are the core issues.

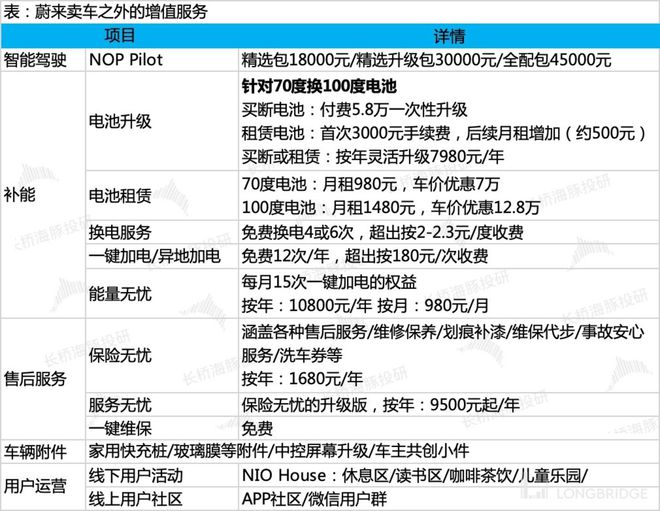

The only thing that came up a little bit this quarter was auto revenue other than auto sales, which hit 1.45 billion this quarter, a lot more than the market expected 11-1.20 billion.

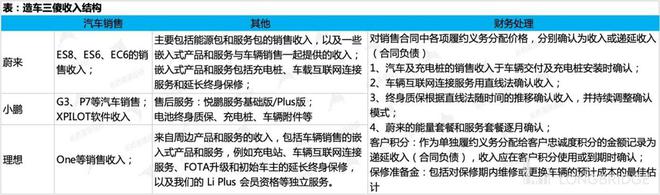

NIO’sOther business revenue sources primarily include revenue from the sale of energy and service packages, as well as revenue generated from embedded products and services that go hand in hand with vehicle sales, such as charging stations, in-vehicle internet connectivity services, and more.

The company has always maintained a high-end strategic positioning, hoping to provide better service and experience to car owners in terms of brand management and user community through better gross margins.

Data source: company earnings, Long Bridge Dolphin Investment Research

Data source: the company’s official website, Long Bridge Dolphin Investment Research

In addition, at the Berlin conference of NIO last October, the overseas models were mainly charged by fixed lease and floating subscription. For example, the rental time provided by the fixed rental fee is generally 1-5 years, and the fixed monthly rent is adopted. For short-term flexible cars, monthly subscriptions can be used. Short-term subscriptions can be cancelled at any time two weeks in advance. Vehicles can be replaced at will, and as the age of the car increases, the monthly fee will be reduced accordingly.

The additional growth in other revenue this quarter is expected to be related to NIO’s overseas sales growth: from January to April, NIO sold more than 150 vehicles in Germany, more than 184 in Norway, and more than 450 worldwide, which should contribute to this part of the revenue.

But the problem here is that, because these markets are in the early stages of development, when they contribute revenue, they basically lose money early on. So the rest of the business saw revenue increase this quarter, but the losses were also severe: less than 1.50 billion revenue in the first quarter, costs were almost 1.80 billion, and the gross loss ratio was 21%.

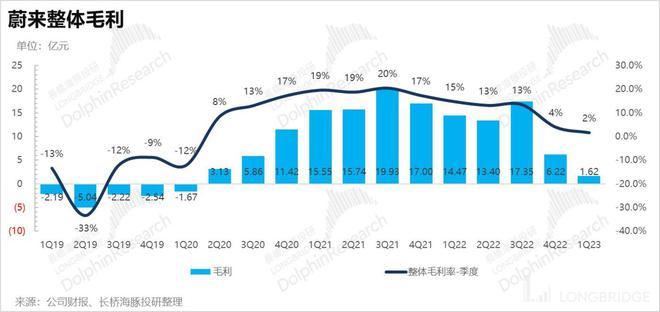

IV. Gross profit is almost "zero"

If the fourth quarter NIO gross profit was miserable, the first quarter was even more miserable, because other income business directly gross loss, and the car sales business sold cars 9.20 billion, only earned less than 500 million gross profit. The overall group level gross profit is only 160 million, no better.

Invest "a lot of money"

Although after subtracting external costs, only gross profit 100 million, but expenses are not less: R & D expenses 3.10 billion, basically within the normal range between 30 and 3.50 billion of the company’s original quarterly guidance; sales and administrative expenses 2.45 billion, just a little less than the market expected 2.70 billion.

Overall, due to the fact that NIO wants to do too many things and has too many dreams in R & D, the possibility of cost reduction in R & D is very small. So far, I have not seen it openly reflect on cost reduction and efficiency like Xiaopeng.

In the sales system, NIO has always been a "warm user" approach, and sales have not seen very clear signs of control.

Six, NIO has passed the life and death tribulation again

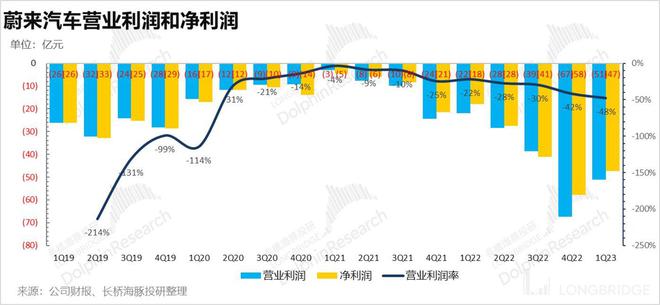

The same painting style as the fourth quarter, but it came more tragically: delivery pulling hips, income pulling hips, gross profit margin pulling hips, cost and investment rigidity, and operating profits are hotWhat is it?

The single-quarter operating loss 5.10 billion; the operating loss rate was 48%, a new high in the past three years.

Summary:

In the eyes of Dolphin Lord, internal reflection and rapid adjustment in the current state of NIO may be more important than boasting and describing the grand blueprint of 5-10 years.