His net worth has shrunk by 200 billion. How does "Mr. Twitter" Musk tell the Tesla story well?

Author | Wang Yajun

Cover Source | Douban Entry

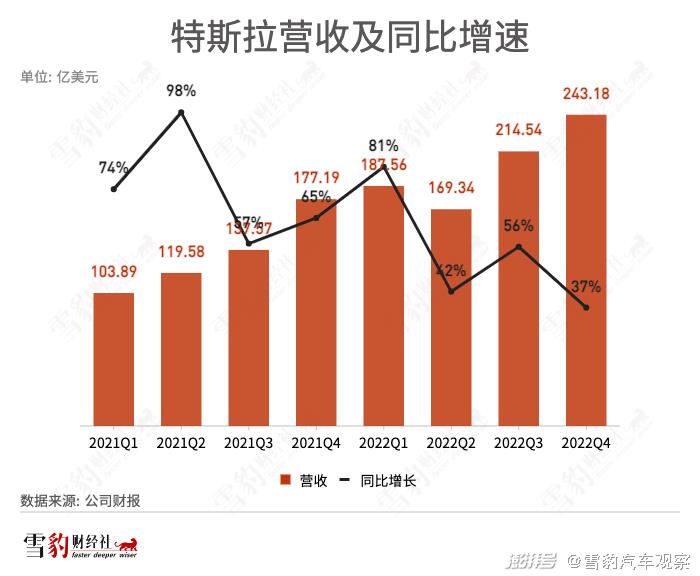

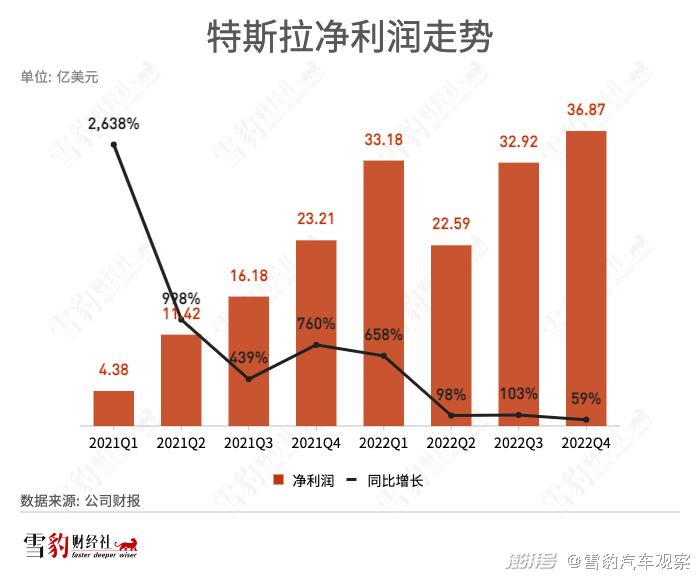

On January 26th, Beijing time, Tesla released the latest financial report: in the fourth quarter of 2022 (hereinafter referred to as Q4), the revenue increased by 37% year-on-year to US$ 24.318 billion, and the net profit increased by 59% year-on-year to US$ 3.687 billion, both hitting record highs and exceeding market expectations.

During the period, Tesla’s vehicle production and delivery both reached new highs: Q4 produced 439,701 vehicles and delivered 405,278 vehicles, up 44% and 31% respectively.

On the first trading day after the financial report was released, Tesla closed up nearly 11% and its market value returned to 500 billion US dollars.

DanielIves, a well-known Tesla bull and Wedbush analyst, believes that Q4 in 2022 will be "one of the most important financial reports in Tesla’s history" because its dominant position in the electric vehicle market is facing new resistance in the past few years.

Before the financial report was released, Tesla took the lead in the unprecedented price reduction promotion in the domestic market on January 6, and then spread the price war to the United States, Europe and other places. Musk said in the earnings conference call that he saw the strongest order in Tesla’s history in January, and the current number of orders is almost twice the production capacity.

In 2023, Tesla gave a delivery target of 1.8 million vehicles in the financial report, an increase of 37% compared with 2022, which was lower than the previously set long-term target (an annual increase of 50%). However, Musk is also optimistic that if there is no external interference, 2 million cars may be produced and sold in 2023.

The price of cars has dropped, but the growth rate of delivery has slowed down.

In Q4 of 2022, Tesla, the "price butcher", once again showed the cutting edge of price reduction.

Since October, 2022, Tesla has successively reduced prices in China and North America. Musk’s goal is to sell all the cars produced in Q4 that year and usher in an "epic year-end".

However, due to the small price reduction, the effect of exchanging price for quantity is not satisfactory. Tesla delivered a total of 405,300 vehicles in Q4, with a year-on-year growth rate slowing from 71% in the same period of last year to 31%, and a year-on-year revenue growth rate of 37%, a record low in the past two years. MarkDelaney, an analyst at Goldman Sachs, believes that Q4′ s delivery data is "an increasing negative factor".

In Q4 last year, Tesla’s output exceeded the delivery by 34,423 vehicles, and the annual difference was 55,769 vehicles. In 2022, Tesla delivered a total of 1,313,800 vehicles, which failed to reach the annual target (1,404,100 vehicles), and the throne of the annual new energy vehicle sales crown was also taken away by BYD.

As the most profitable new energy vehicle company in the world, Tesla’s net profit growth rate slowed down obviously in Q4 last year, even less than Q2, which was affected by epidemic and supply chain.

The price reduction promotion also lowered the gross profit margin. Tesla Q4′ s gross profit margin was 23.8%, down 3.6 percentage points from the same period of last year and 1.3 percentage points from the previous month, hitting a new low in nearly seven quarters.

In the face of the decline in profitability brought about by price cuts, Musk believes that Tesla can get compensation from autonomous driving.

In a Twitter space discussion at the end of 2022, Musk said that the value of a car that can drive automatically is much higher than that of a non-self-driving car. Even if the profit margin is extremely low when selling a car, it can be upgraded to automatic driving. It can bring a lot of income. "Only Tesla can do this."

FSD(FullSelf-Drive) brought Tesla $324 million in revenue in Q4. Tesla has released a beta version of FSD to almost all customers in North America, and the number is about 400,000.

In addition to the slowdown in growth and the decline in gross profit margin, Musk, as the soul of Tesla, was also distracted by Twitter.

Musk proposed to acquire Twitter in April 2022 and entered the company in October. After the acquisition, Musk reduced his holdings of Tesla shares worth nearly $23 billion. KoGuanLeo, the third largest individual shareholder of Tesla, said that Musk gave up Tesla and Tesla had no CEO.

The cold winter of Q4, together with Twitter nightmare, has impacted Tesla’s market value and Musk’s net worth. As of the close of the last trading day in 2022, Tesla’s share price fell by more than 50% in the fourth quarter. Affected by this, Musk became the first rich man in history to lose $200 billion.

Weakened first-Mover advantage

Behind the slowdown in delivery, revenue and net profit growth is Tesla’s insufficient demand challenge in Q4. According to the financial report, Tesla Q4′ s global inventory supply days reached 13 days, up 225% year-on-year, the highest in the whole year.

Bernstein, an American investment research institute, said that the price reduction of Tesla’s promotion in China and the United States in 2022 means that Tesla may have a demand problem.

The long gap period of models is one of the important reasons for the decline in Tesla demand. In 2022, the combined delivery of Model3 and ModelY accounted for 94.92% of Tesla’s total annual delivery, but the release time of these two models should be traced back to 2016 and 2019 respectively.

Merrill Lynch once predicted in a report that by 2025, Tesla’s American electric vehicle market share will drop from the current 70% to 11%, because Tesla did not expand its product portfolio quickly enough, while traditional car manufacturers and new forces making cars are improving their product lineup. Standard & Poor’s Global Mobile also believes that although Tesla is still the best-selling electric vehicle brand in the United States, its competitors are launching more and more affordable models, and Tesla’s dominant position in the electric vehicle market is being weakened.

During the gap period of Tesla models, the pattern of new energy vehicle market in China has also changed greatly. According to the data of the Association, the market share of BYD’s new energy passenger cars increased from 19.5% in 2021 to 31.7% in 2022. In the same period, Tesla decreased from 10.7% to 7.8%. Wei Xiaoli also broke through the annual delivery of 100,000 vehicles in 2022, and plans to launch more models.

At the same time, Tesla’s technological aura is gradually eclipsing.

Tesla’s brand power is centered on the exploration and landing of new technologies, especially the combination with FSD. Musk also predicted that "autopilot software will become Tesla’s most important profit point", but FSD has never achieved true full autopilot. According to the calculation of CITIC Securities, from 2019 to 2021, the revenue of FSD accounted for 3.4%, 2.8% and 1.7% respectively.

Will the price war last?

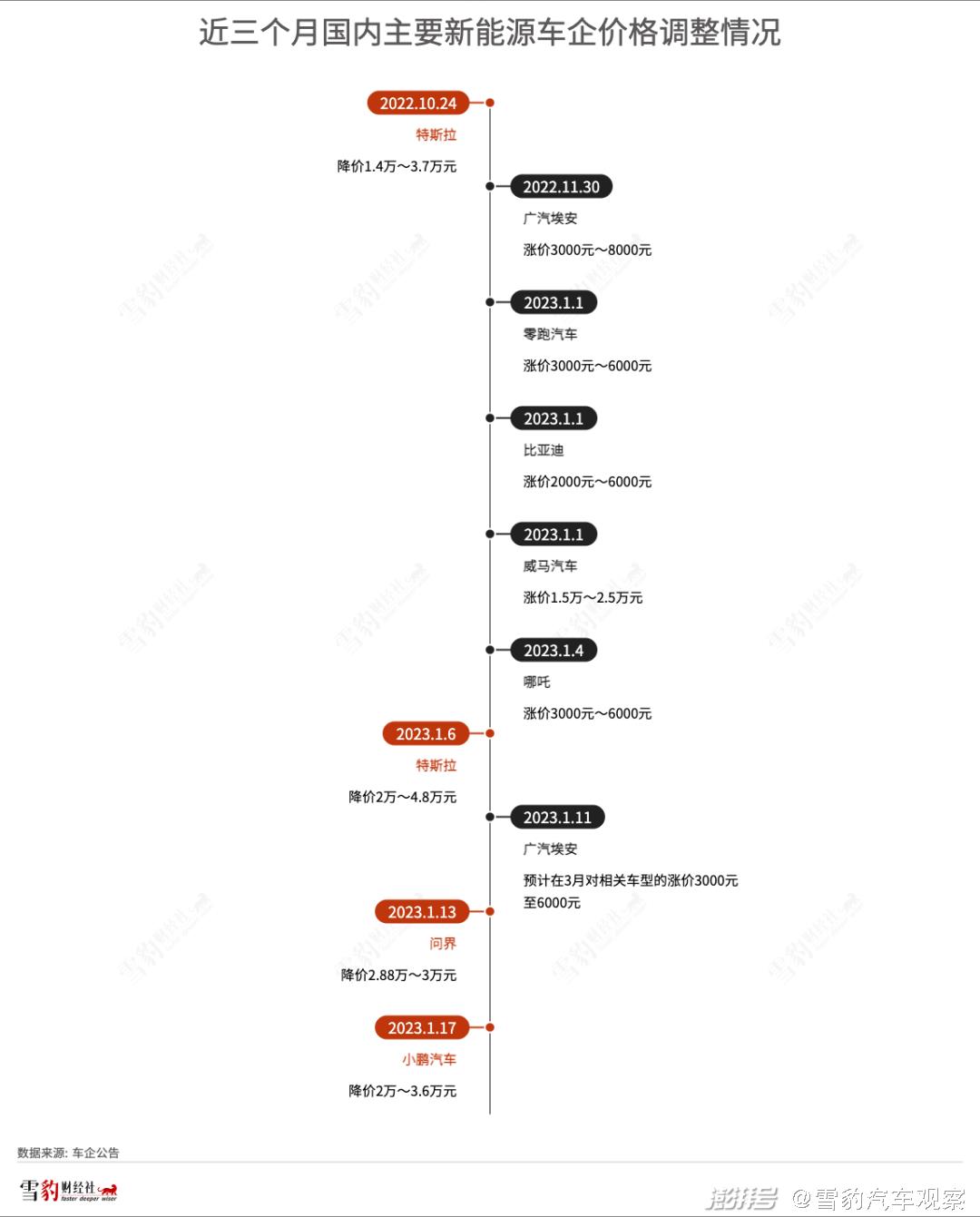

At the beginning of 2023, Tesla cut prices sharply on a global scale.

On January 6th, all the models on sale in Tesla China market were reduced in price, with a drop of 20,000 ~ 48,000 yuan, and the promotion was unprecedented. The following week, Tesla spread the bonfire of price war to Japan, South Korea, North America, Europe and other places.

Price reduction is a double-edged sword. Daniel, the aforementioned Wade Bush analyst, believes that Tesla’s price reduction may increase the global delivery this year by 12% ~ 15%. Deutsche Bank predicts that Tesla’s gross profit margin will drop by 3 percentage points in 2023 compared with 2022.

At the earnings conference call, Tesla did not release the expectation of continuing to exchange prices. Musk said that Tesla raised the price slightly because the demand after the price reduction far exceeded the output. On January 24, Tesla raised the price of the ModelY dual-motor all-wheel drive model sold in the United States by $500. Tesla CFOZachKirkhorn also said in the earnings conference call that the gross profit margin of automobiles will be higher than 20% this year.

Tesla’s price reduction action is bound to cause a rebound of competitors. Haitong Securities believes that Tesla will increase market sales by reducing prices, announcing that the electric vehicle industry will officially enter fierce competition in 2023, and global car companies will face great pressure to compete head-on.

On January 13, AITO asked the community to announce that the price of some of its models would be lowered by 28,800 ~ 30,000 yuan. On January 17th, Xpeng Motors, which is still at a loss, announced that it would adjust the price of its G3i/P5/P7 models, with an overall decrease of 20,000 ~ 36,000 yuan.

The day after the official announcement of price reduction, He Xiaopeng, chairman of Xpeng Motors, said at the annual summary meeting, "Either you are brilliant enough with everyone, or you will die with a bang".

BYD, which did not follow the price cut, launched a million-class luxury car the day before Tesla’s domestic price cut in an attempt to get more cakes in the high-end market.

In the face of rivals who are chasing after each other step by step, Tesla urgently needs to find new sales growth points.

FranzvonHolzhausen, chief designer of Tesla, said on January 16th that Cybertruck, a pure electric pickup truck, had finished the design and was ready to put into production. The market generally believes that if Cybertruck can be listed as scheduled, it will become a new growth point for Tesla in the North American market in 2023.

Cybertruck; Source: Tesla official Weibo

Musk said in the earnings conference call that Cyberruck may start production in the summer of 2023, but the real mass production work will begin in 2024, and Cyberruck’s contribution to profits will not be great this year.

Cheap models are another sales growth point besides Cybertruck. Musk predicts that the cost of the next-generation car platform will be half that of the second-generation platforms (Model3 and ModelY), and its output may be higher than the sum of all the company’s current products.

Tesla said in Q4 financial report that more details of the next-generation car platform will be released on March 1, 2023, Investor Day. Analysts of venture capital firm LoupVentures believe that Tesla’s affordable model Model2 will not be launched until 2024.

In addition, Tesla has to consider the impact of the macro environment.

In a Twitter discussion at the end of 2022, Musk believed that the severity of the economic recession in 2023 was equivalent to that in 2009, which would affect the demand for automobiles and lead to an increase in the consumption cost of automobiles. However, in the earnings conference call, Musk also said that the economic recession will reduce Tesla’s costs, which in turn will bring higher profit margins. However, he stressed that this was only his guess.

Twitter is also a variable that Tesla will face this year. In December 2022, Musk launched a vote on whether he should step down as CEO of Twitter. 57.5% of users thought he should resign, but Musk still serves as CEO of Twitter.

In the earnings conference call, Musk "showed off" his Twitter account with 127 million fans, and said that Twitter created demand for Tesla. At present, Musk has renamed his Twitter account "Mr. Twitter".

Competition in the industry has intensified and the first-Mover advantage has diminished. In 2023, Tesla will still face severe challenges.