The three A-share indexes collectively closed down in early trading. By midday, the Shanghai Composite Index was down 0.29%, the Shenzhen Component Index was down 0.46%, the Growth Enterprise Market Index was down 0.49%, and the Beizheng 50 was up 2.26%. The half-day turnover in Shanghai and Shenzhen stock markets was 488.7 billion yuan. More than 3,600 stocks in the two cities fell. Northbound funds sold 4.685 billion yuan in half a day.

On the theme of the sector, media, games, optical modules and other sectors were among the top gainers; Agricultural machinery, auto parts and other sectors are floating green.

On the disk, media and game stocks continued to strengthen, with (), () and () daily limit, () and () rising by over 5%. The concept of CPO was among the top gainers, () rose by over 14%, and () and () both had daily limit. Media stocks are active again and again, () up more than 15%, (), publishing media, Beijing culture daily limit. The Beizheng 50 Index rose more than 2%, and Liujin Technology rose more than 15%. The auto parts sector was among the top losers, with () down, (), () and () leading the decline. In addition, on the high standard, the word () recorded 6 consecutive boards, and Longban Media recorded 5 consecutive boards.

Plate analysis:

Straight flush hot stock list:

Transaction review:

At 09: 25, the A-share market opened, the Shanghai Composite Index opened 0.11% lower, the Shenzhen Component Index opened 0.16% lower and the Growth Enterprise Market Index opened 0.26% lower.

At 09:26, the high-end stocks started to fall, and the words (), () and Weishi Electronics went down, and () and () went down one after another.

At 09:27, the media and game stocks were active at the beginning, with Beijing Culture 2 being linked to the board, Wentou Holdings’ daily limit, Shanghai Film, (), () and () rising.

At 09:29, Xinyada stepped out of six consecutive boards with a daily limit of over 500 million yuan.

At 09:31, the Hang Seng Technology Index fell more than 1%, and the Hang Seng Index is now down 0.82%.

At 09:32, the concept of small metal went down in the morning, () fell more than 5%, and (), (), (), (), () and so on went down one after another.

At 09: 35, the concept of AIGC strengthened in early trading, () rose by over 13%, () rose by over 10%, (), (), Kunlun Wanwei and Danghong Technology rose by over 5%.

At 09: 40, the concept of CPO rose sharply, and Guang Chen rose by over 11%, followed by Wufang Optoelectronics, Yuanjie Technology, (), () and ().

09:42 Food stocks fluctuated and weakened, () fell by more than 7%, () and Huifa Food fell by more than 5%, and (), () and () fell by more than 3%.

At 09:44, the Hang Seng Index fell more than 1%, the Hang Seng Index is now down 1.28%, and Yaoming Bio and China Merchants Bank fell more than 4%.

At 09:49, the concept of retail fell, () approached the down limit, () fell more than 8%, (), (), (), () and so on all went down.

At 09:58, the Beizheng 50 Index rose more than 3% against the market, while the daily limit of Huaxin Yongdao and Tianrun Technology was 30cm, while that of Liujin Technology, Luqiao Information and Guoyuan Technology rose more than 15%.

At 10:12, the volume of Huaxia Ophthalmology dropped by 14%. In the news, Su Qingcan, the chairman of the company’s announcement, was detained by the Shanghai Supervision Committee for personal reasons.

At 10:13, the main contract of lithium carbonate hit the daily limit, with an increase of 6.99% to 95,600 yuan/ton.

At 10:15 (), it rose by more than 6% in intraday trading, and the turnover exceeded 2.4 billion yuan.

At 10:21, the pork plate bottomed out, and (), () and () rose by more than 5%, while (), () and () surged in succession.

At 10:23, the concept of computing power leasing was divided in intraday trading. (1) The daily limit, Hengxin Dongfang, (2) and (3) followed up, (2) the daily limit, (3) and (3) followed down.

At 10:38, the concept of optical module continued to strengthen, with Guang Chen hitting a daily limit of 20cm, Ruiruikangda and Wufang Optoelectronics reaching a daily limit, and (), () and Zhongji Xuchuang all went higher.

At 10:48, the concept of auto parts fluctuated and went down. Changchun Yidong hit the limit, Tianlong and Shenglong shares fell more than 8%, and Yunnei Power, (), () and () fell more than 5%.

At 10:50, the main contract of soda ash futures increased to 9%, and it is now reported at 2260 yuan/ton.

At 10:51, real estate stocks bottomed out and rose, () daily limit, (), (), (), (), () and () followed suit.

News:

1. WTI crude oil futures fell below the integer mark of $70/barrel for the first time since July 4th, with a drop of more than 3%.

WTI crude oil futures fell below the integer mark of $70/barrel for the first time since July 4, with a drop of more than 3%.

2. SpaceX, a space exploration company owned by Musk, will trade shares at a valuation of more than $175 billion.

SpaceX, Musk’s space exploration company, will trade shares at a valuation of more than $175 billion. (Sina Finance)

3. Tesla plans to restart the Shanghai Phase III factory project, and the energy storage products will be supplied to China.

According to LatePost, Tesla is planning to restart the construction of the third phase automobile factory in Shanghai. Tesla disclosed in April this year that it would build a new energy storage battery factory with an annual output of 40 GWh in Shanghai, which will be put into operation in the second quarter of next year. At that time, it did not mention the expansion of the automobile factory. Besides, Tesla’s energy storage battery products, which will be produced in Shanghai next year, will be sold in China. At present, the Shanghai factory energy storage project has recruited the person in charge of research and development, and is recruiting the person in charge of sales.

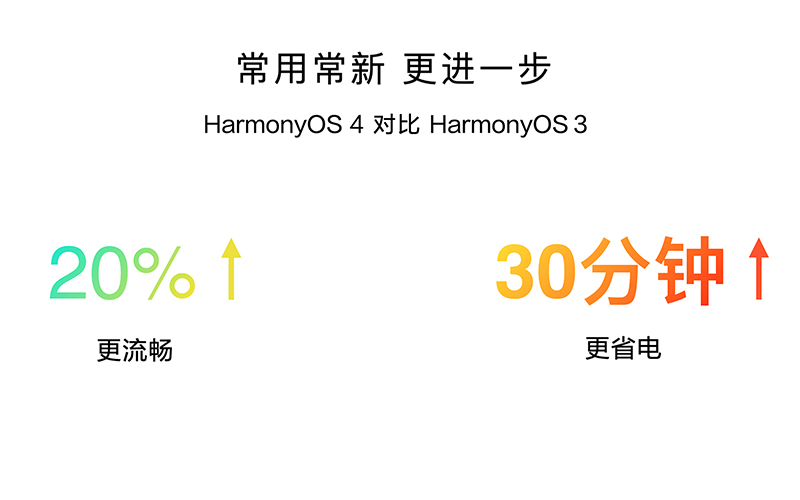

4. HarmonyOS Ecology ushered in an important breakthrough in the catering field. Many enterprises started the development of native applications in HarmonyOS.

According to the China Securities Journal, on December 6th, McDonald’s China and Huawei reached a cooperation agreement in HarmonyOS, officially announcing that McDonald’s China APP will start HarmonyOS native application development based on HarmonyOS NEXT. With more than 5,500 restaurants in China market, more than 200,000 employees and more than one billion customers each year, McDonald’s China has become the first large-scale chain catering enterprise in the world to start the development of HarmonyOS’s native application. The McDonald’s China APP officially announced the launch of the native application development in HarmonyOS, which means that HarmonyOS Ecology has made a major breakthrough in the catering field. At present, Meituan, Qunar, Sina, Nail, Ant Group, Xiaohongshu, 58 Group, Bili Bili and Gaode Map have started the development of native applications in HarmonyOS.

5. Ministry of Industry and Information Technology: Promote the coordinated development of "Double Gigabit" and accelerate the layout of intelligent computing facilities.

According to Guan Wei of the Ministry of Industry and Information Technology, on December 6, the Ministry of Industry and Information Technology held a symposium of the National Communications Administration and a symposium on information and communication supervision. The meeting emphasized that the information and communication industry is a strategic, basic and leading industry of the national economy. It is necessary to persist in promoting the modernization of the industry, continuously consolidate and enhance the competitive advantage and leading position of the industry, persist in empowering the digital transformation of the real economy, and consolidate the technology, network, application, market and security foundation of services to support new industrialization, and play a greater role in promoting new industrialization and building a modern industrial system. It is necessary to speed up the optimization and upgrading of new information infrastructure, promote the coordinated development of "double gigabit", speed up the layout of intelligent computing facilities, optimize the internet architecture, and improve the green and low-carbon level of information infrastructure. It is necessary to speed up tackling key core technologies, promote the R&D and innovation of 6G technologies, and build a modern industrial system of information and communication. It is necessary to deepen the empowerment of integrated applications, issue guidance on the high-quality development of industrial Internet, promote the "100 million" action of 5G factories, and accelerate the industrial "intelligent transformation from digital to network". Support platform enterprises to expand consumption scenarios, empower manufacturing and enhance international competitiveness. It is necessary to strengthen the network and data security system and capabilities, strengthen the construction of technical support capabilities, improve the data security management level of the industry, and promote the innovative development of the network and data security industry. It is necessary to further promote the construction of a new industry supervision system, improve the all-round, multi-level and three-dimensional supervision system, improve the supervision of the whole chain and all fields before and after the event, actively and orderly promote the opening up of the industry, and further promote the construction of work style and rectification work.Deepen the supervision of key areas such as APP. Improve the emergency communication plan system and command system, and ensure communication services for major events and emergencies.

6. CITIC Securities: Google Gemini model was released, and AI entered the multi-modal era.

Citic Securities Research Report pointed out that recently, Google announced the release of a new generation of large model Gemini, which once again triggered the market’s continued attention to the artificial intelligence industry. As the first multimodal model released by Google and the world, Gemini model is the first model to surpass human experts on MMLU in performance. According to the volume, the model is divided into three versions: Gemini Ultra, Gemini Pro, and Gemini Nano, which support cloud and edge measurement. At the same time, Google simultaneously released the latest version of the computing chip TPU v5p, which is 2.3 times more cost-effective than the previous generation TPU v4. We believe that the official release of multimodal Gemini model can not only broaden the application scenarios, but also bring about the continuous upgrading of computing power requirements. We continue to be optimistic about the prospects of the subsequent AI industry, and believe that the release of subsequent GPT-5 models will also bring more catalysis.

7. Western Digital issued a price increase letter. It is expected that the cumulative price increase of NAND chip products in the next few quarters will be 55%.

According to Taiwan media quoted by Cailian, Western Digital (WD), the world’s fourth largest storage NAND Flash supplier, sent a price increase notice letter to customers, emphasizing that the price of NAND chip products will rise periodically in the next few quarters, and the expected cumulative increase is 55%. This wave of NAND chip quotation is unstoppable. At this stage, the industry is optimistic that the quotation will stop falling and rebound. Compared with the current situation in which suppliers and customers individually notify to adjust the quotation, Western Digital sends a price increase letter to customers, and the expected price increase is amazing, opening the first shot of a comprehensive price increase in the industry.

8. The EU is about to reach a landmark artificial intelligence supervision bill.

According to Reuters, quoted by Sina Finance, people familiar with the matter said that the EU is about to reach an agreement on the supervision agreement on artificial intelligence, which may be the most extensive and influential in the West. Negotiators have agreed to control a series of generative artificial intelligence tools such as ChatGPT of OpenAI and Bard of Google. Representatives from the European Commission, the European Parliament and 27 member states reached a compromise at the meeting that began on Wednesday afternoon and lasted for several hours, which brought the parties closer to reaching a formal agreement on a broader legislation, namely the Artificial Intelligence Act. In the absence of any meaningful action by the United States, this move will set the tone for the supervision of generative artificial intelligence in developed countries. For months, policymakers have been trying to finalize the wording of the Artificial Intelligence Act and try to get it passed before the European election in June next year.

9. General Administration of Customs: China’s foreign trade import and export increased by 1.2% in November this year.

The General Administration of Customs announced today that in November this year, the total import and export value of China’s goods trade was 3.7 trillion yuan, up 1.2% year-on-year, and the steady and positive trend of foreign trade was further consolidated. According to customs statistics, in the first 11 months of this year, the total import and export value of China’s goods trade was 37.96 trillion yuan, which was basically the same as that of the same period last year. Among them, exports reached 21.6 trillion yuan, up 0.3%; Imports reached 16.36 trillion yuan, down 0.5%. In the month of November, the import and export was 3.7 trillion yuan, up 1.2% year-on-year; Exports were 2.1 trillion yuan, an increase of 1.7%; Imports reached 1.6 trillion yuan, up 0.6%.

10. Ministry of Science and Technology: It will study and form the scheme of high-speed maglev test line with a speed of 600 kilometers per hour.

According to Zhongxin. com, the Ministry of Science and Technology issued the Reply to Recommendation No.2199 of the First Session of the 14th National People’s Congress in official website. The Ministry of Science and Technology said that it will actively support the basic research of magnetic levitation power technology based on the "14 th Five-Year Plan". For example, in the key special project of "transportation equipment and intelligent transportation technology", we will continue to support the research on the engineering technology of high-speed maglev transportation system and the integration technology of operation system, and study and form a high-speed maglev test line scheme with a speed of 600 kilometers per hour and a complete set of commercial operation solutions to provide scientific and technological support for the development of high-speed maglev transportation in China.