With the rapid development of the new energy vehicle market, more and more domestic brands have emerged in this field and launched electric cars with powerful performance and full sense of technology. Facing the dazzling array of vehicles, who is the "ceiling" of domestic new energy vehicles? This paper will take you to analyze ten popular domestic electric vehicles one by one, and make a detailed comparison from the aspects of power system, body size, endurance and intelligent configuration.

Guide price: starting from 249,800 yuan

Power system: Zhiji S7 is equipped with a dual-motor system, with a total output of about 400 horsepower and an acceleration time of 100 kilometers within 4 seconds, showing excellent acceleration capability.

Cruising range: It can travel more than 500 kilometers on a single charge, meeting daily and long-distance driving needs.

Body size: The body length of Zhiji S7 is about 4980mm, and the wheelbase is 2900mm, which ensures sufficient internal space.

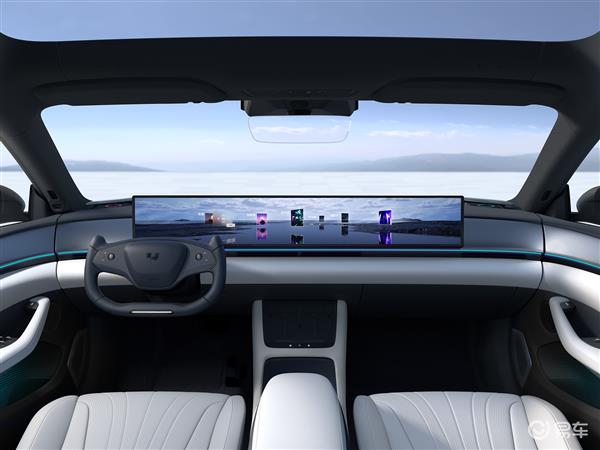

Intelligent configuration: The car is equipped with an advanced intelligent driver assistance system and a large-size central control panel, providing a convenient intelligent interconnection experience.

With its balanced performance, excellent battery life and intelligent configuration, Zhiji S7 occupies an important position in the mid-to-high-end market and becomes an ideal choice for users who pursue a sense of technology and driving pleasure.

Guide price: starting from 209,900 yuan

Power system: Krypton 007 is available in single-motor and dual-motor versions, with the maximum output power of 300 HP and 450 HP respectively, and the power is strong and stable.

Cruising range: Under standard test conditions, the cruising range of Krypton 007 reaches 600 kilometers, which is suitable for long-distance driving.

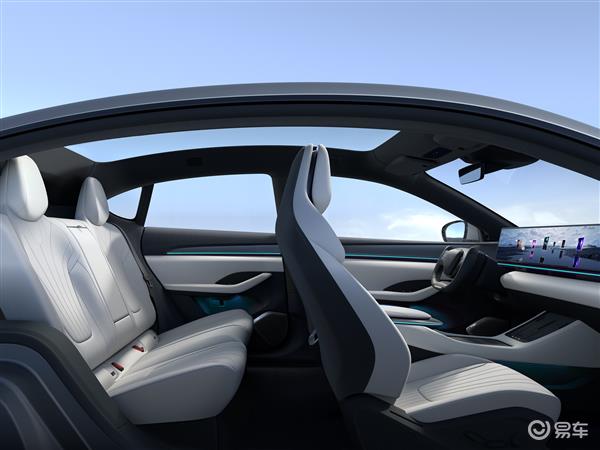

Body size: The body length is about 4950 mm, the wheelbase is 2950 mm, and the interior space is spacious and comfortable.

Intelligent configuration: Extreme Krypton 007 is equipped with panoramic sunroof, intelligent driving assistance system and intelligent voice assistant, which is full of science and technology.

The luxurious interior and advanced technology configuration of Krypton 007 make it a popular choice for consumers who pay attention to quality life.

Guide price: starting from 185,800 yuan

Power system: single motor configuration, output power of 350 HP, suitable for a variety of driving scenarios.

Cruising range: The Lectra 07 has a cruising range of 500 kilometers, ensuring long-term driving without frequent charging.

Body size: the length is 4930mm, and the wheelbase is 2940mm, which provides sufficient space for riding and storage.

Intelligent configuration: Intelligent driving assistance system, lane keeping assistance and automatic parking greatly improve driving safety.

As a fashionable intelligent electric car, Linke 07 has won the favor of young consumers through perfect safety configuration and intelligent driving technology.

Guide price: starting from 189,000 yuan

Power system: dual-motor system, with a total output of 400 HP, supporting all-wheel drive.

Cruising range: The cruising range of Extreme Yue 07 is about 600 kilometers, which is very suitable for long-distance driving.

Body size: The length of the car is 4,970 mm and the wheelbase is 2,955 mm, providing a spacious interior space.

Intelligent configuration: equipped with intelligent navigation, voice control and car networking functions, the user experience is excellent.

With its excellent performance and reasonable pricing, Extreme Yue 07 has become a dark horse in the mid-market and attracted a large number of consumers who are pursuing high cost performance.

5. Xiaomi Su7: A New Breakthrough of Technology Giants

Guide price: starting from 215,900 yuan

Power system: Xiaomi Su7 is equipped with a 430 HP dual-motor system, which supports all-wheel drive and provides excellent power output.

Cruising range: The cruising range of 600 kilometers makes this car perform well in long-distance driving.

Body size: 5000 mm long and 3000 mm wheelbase, providing comfortable interior space.

Intelligent configuration: Xiaomi Su7 is equipped with powerful intelligent interconnection functions, including intelligent voice assistant and remote control, which further enhances the user experience.

As a masterpiece of technology giant Xiaomi’s entry into the automobile market, Su7 not only continues the tradition of high cost performance of Xiaomi products, but also brings amazing intelligent technology experience.

Guide price: 995,800 yuan

Power system: Wangwang U7 is equipped with a 700-horsepower three-motor system, which provides superior power output, and the acceleration time of 0-100 km/h is less than 3 seconds.

Cruising range: The cruising range is over 700 kilometers, which is suitable for the long-distance travel needs of high-end users.

Body size: the length of the car is 5150 mm, the wheelbase is 3100 mm, and the interior is luxurious and spacious.

Intelligent configuration: top intelligent driving system and luxurious interior, positioning the ultra-high-end market.

Looking forward to the ultra-high performance and luxury configuration of U7, it will become the "ceiling" in the high-end electric vehicle market, and it is the ultimate choice for a few rich people and top consumers.

Guide price: starting from 159,000 yuan

Power system: equipped with 250 horsepower single motor system, suitable for daily city driving.

Cruising range: The cruising range of 450 kilometers is enough to meet the daily commuting needs.

Body size: 4850 mm long and 2900 mm wheelbase, providing a compact and practical interior space.

Intelligent configuration: basic intelligent driving assistance function and in-vehicle interconnection system are economical and practical.

As an economical and practical electric vehicle for home users, Dongfeng Eπ007 has become a best-selling model in the market with its low price and stable performance.

Guide price: starting from 188,000 yuan

Power system: Tucki P7 provides two power configurations of 360 HP and 500 HP, supporting high-speed driving and long-distance driving.

Cruising range: The cruising range is 600 kilometers, and the performance is excellent.

Body size: 4880 mm long, 2998 mm wheelbase, spacious interior, suitable for family use.

Intelligent configuration: equipped with XPilot automatic driving function, it supports expressway automatic driving and automatic parking in parking lot.

With its intelligent automatic driving system and long endurance, Tucki P7 has become the first choice for technology enthusiasts and users who pay attention to driving experience.

Guide price: starting from 189,900 yuan

Power system: Feifan F7 is equipped with a 450 HP dual-motor system, providing all-wheel drive function.

Cruising range: cruising range is 550 kilometers, which can meet the driving needs of most users.

Body size: the length of the car is 4900 mm and the wheelbase is 3000 mm. The interior design is full of modernity.

Intelligent configuration: Intelligent driver assistance system and efficient energy management system make this car find the best balance between performance and practicality.

Feifan F7 is an electric car with high cost performance, which is suitable for those consumers who value modernity and practicality.

Guide price: starting from 428,000 yuan

Power system: Weilai ET7 is equipped with 650 HP dual-motor all-wheel drive system, providing top-level power output.

Cruising range: With a cruising range of 700 kilometers, it is one of the longest electric vehicles on the market at present.

Body size: the length of the car is 5100mm, the wheelbase is 3060mm, and the interior is extremely luxurious.

Intelligent configuration: with the world’s leading autonomous driving technology and top-class luxury configuration in the car, it is a leader in the high-end market.

With its luxurious configuration and excellent performance, Weilai ET7 has become one of the flagship models in the domestic electric vehicle market, and it is the best choice for users who pursue the ultimate driving experience and luxury enjoyment.

Who is the real "ceiling" in the domestic new energy vehicle market? These models have their own advantages, from the economical Dongfeng Eπ007, to the scientific and technological Xiaomi Su7, and then to the luxurious U7 and Weilai ET7, each car occupies an important position in different market segments. For consumers, which car to choose depends on your most important needs-performance, intelligence, luxury configuration, or economy and practicality?