Notice on Issuing the Trial Measures for Issuing Early Warning Signals of Sudden Meteorological Disasters

Release date: June 12, 2008

Notice on Issuing the Trial Measures for Issuing Early Warning Signals of Sudden Meteorological Disasters

(Qi Fa [2004] No.206)

Meteorological bureaus of all provinces, autonomous regions and municipalities directly under the Central Government and directly affiliated units:

In order to standardize the release of early warning signals for sudden meteorological disasters, enhance the national awareness of disaster prevention and mitigation, improve the efficiency of the use of early warning information for meteorological disasters, effectively prevent and mitigate meteorological disasters, and protect the safety of the country and people’s lives and property, our bureau has formulated the Trial Measures for the Release of Early Warning Signals for Sudden Meteorological Disasters (hereinafter referred to as the Trial Measures), and we hereby notify you as follows:

(a) to attach great importance to and effectively organize this work. Timely and accurate release of meteorological disaster warning signals is an important measure to further strengthen meteorological disaster management and improve the ability and level of meteorological public services. All units should attach great importance to it, carefully organize it, pay close attention to its implementation, and earnestly do this work well.

(two) to actively and steadily promote this work. All units should seriously study and understand the content and essence of this "Trial Measures". For the eastern coastal areas with relatively developed social economy, important large and medium-sized cities and other areas with relatively mature conditions, we should step up the implementation of this work first. For areas with immature conditions or immature projects, we should actively grasp and create conditions to promote this work. At the same time, it is necessary to strengthen publicity, strengthen communication with relevant local departments, and solve the way of issuing early warning signals.

(3) Guangdong, Shanghai, Fujian and other provinces and cities that have carried out this work should strengthen coordination and communication with local governments before the end of the year, and revise the trial measures that have been implemented so as to ensure that there are unified standards nationwide next year and that this work is carried out in a standardized and orderly manner.

(four) to carry out this work in strict accordance with the standards of the "Trial Measures". If local early warning standards are allowed to be formulated in some areas, such as rainstorm and high temperature, it should be reported to the Department of Prediction and Disaster Reduction of China Meteorological Bureau for approval on the basis of extensive consultation with experts.

(five) the production of disaster early warning products involved in the "Trial Measures" shall be implemented according to the relevant documents of China Meteorological Bureau.

Annex: Trial Measures for Issuing Early Warning Signals of Sudden Meteorological Disasters

Attachment: Early Warning Signals and Defense Guidelines for Sudden Meteorological Disasters

August 16th, 2004

Attachment:

Trial Measures for Issuing Early Warning Signals of Sudden Meteorological Disasters

Article 1 In order to standardize the release of early warning signals of sudden meteorological disasters (hereinafter referred to as early warning signals), enhance the national awareness of disaster prevention and mitigation, improve the efficiency of the use of early warning information of meteorological disasters, effectively prevent and mitigate meteorological disasters, and protect the lives and property of the state and people, these Provisions are formulated in accordance with the Meteorological Law of People’s Republic of China (PRC).

Article 2 These Provisions must be observed in issuing early warning signals of sudden meteorological disasters within the territory of People’s Republic of China (PRC).

Article 3 The term "early warning signal" as mentioned in these Provisions refers to the warning information icons released to the public by meteorological offices and stations with the right to release for effectively preventing and mitigating sudden meteorological disasters. The early warning signal consists of three parts: name, icon and meaning (see annex).

Early warning signals are divided into eleven categories, such as typhoon, rainstorm, high temperature, cold wave, fog, thunderstorm and gale, gale, sandstorm, hail, snowstorm and road icing.

Early warning signals are generally divided into four levels (IV, III, II and I). According to the severity and urgency of the disaster, the colors are blue, yellow, orange and red in turn, and they are marked in Chinese and English, representing general, heavy, serious and particularly serious respectively. According to the characteristics and early warning ability of different disasters, the early warning grades and standards of different disasters are determined.

When a variety of meteorological disasters occur or are predicted to occur at the same time, a variety of early warning signals can be issued simultaneously according to the corresponding standards.

Article 4 The meteorological offices and stations subordinate to the competent meteorological departments at or above the county level shall uniformly issue early warning signals and indicate the areas for early warning of meteorological disasters. No organization or individual may disseminate to the public the early warning signals provided by meteorological stations subordinate to non-competent meteorological departments.

Meteorological offices and stations subordinate to competent meteorological departments at all levels can only issue early warning signals within the responsibility area of this forecast service. The meteorological observatory at a higher level shall strengthen the technical guidance for the release of early warning signals from the meteorological observatory at a lower level, strengthen the consultation and communication on the release of early warning signals from the meteorological observatory at a higher level and the meteorological observatory at a lower level, and ensure the consistency of the release of early warning signals from the meteorological observatory at a higher level and the meteorological observatory at a lower level.

Article 5 The competent meteorological departments at all levels shall timely and accurately issue early warning signals, update or cancel the early warning signals in time according to the weather changes, and notify the people’s government at the same level.

Article 6 The National Meteorological Center and the competent meteorological departments at the provincial level shall, according to the forecasting and early warning capabilities and the weather and climate characteristics, determine the types of early warning signals issued by the responsible areas of this forecasting service and report them to the China Meteorological Bureau for approval; The categories of early warning signals issued by the competent meteorological departments at the city and county levels shall be uniformly determined by the competent meteorological departments at the provincial level and reported to the China Meteorological Bureau for the record.

Seventh competent meteorological departments at all levels should formulate specific procedures for the production and release of early warning signals, and report them to the competent meteorological departments at higher levels for examination and approval to ensure that the production and release work is standardized and orderly.

Eighth competent meteorological departments at all levels should make full use of television, radio, Internet, SMS and other means to immediately release early warning signals to the society, and establish early warning signals to release electronic display boards in prominent positions in urban areas. Meteorological authorities at all levels should take the initiative to strengthen communication with radio stations, television stations, urban construction and information management departments, and establish a working mechanism for issuing early warning signals immediately. Specific measures for broadcasting early warning signals shall be jointly formulated by competent meteorological departments at all levels in conjunction with radio, film and television and information industry departments at the same level.

Ninth competent meteorological departments at all levels should strengthen the infrastructure construction of meteorological disaster monitoring and early warning system, early warning signal production and release system, and constantly improve the local early warning level and broadcast quality.

Tenth competent meteorological departments at all levels shall, in accordance with the provisions of this regulation, compile and publish brochures on meteorological disaster warning signals and preventive measures, and take various means to carry out in-depth publicity.

Eleventh the provisions by the China Meteorological Bureau forecast and disaster reduction department is responsible for the interpretation of.

Article 12 These Provisions shall come into force as of the date of promulgation.

Attachment:

Early warning signals and prevention guidelines for sudden meteorological disasters

A typhoon warning signal

Typhoon warning signals are divided into four levels according to approaching time and intensity, which are represented by blue, yellow, orange and red respectively.

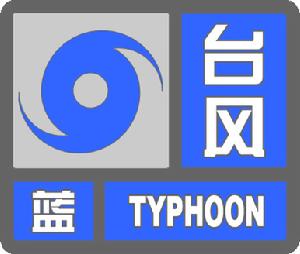

(1) Typhoon blue warning signal

Icon:

Meaning: It may be affected by tropical depression within 24 hours, with an average wind force of more than 6 or a gust of more than 7; Or have been affected by the tropical depression, the average wind force is 6 ~ 7, or the gust is 7 ~ 8 and may continue.

Defense guide:

1. Prepare for windproof;

2. Pay attention to the latest news of tropical depression reported by relevant media and the notice on wind prevention;

3, doors and windows, hoardings, scaffolding, temporary structures and other structures that are easily blown by the wind, and properly arrange outdoor items that are easily affected by tropical depression.

(2) Typhoon yellow warning signal

Icon:

Meaning: It may be affected by tropical storms within 24 hours, with an average wind force of more than 8 or a gust of more than 9; Or have been affected by tropical storms, the average wind force is 8-9, or the gust is 9-10 and may continue.

Defense guide:

1. It is recommended to suspend classes in kindergartens and nurseries when entering the windproof state;

2, close the doors and windows, residents in dangerous areas and dangerous buildings, and ships should take shelter from the wind, notify outdoor workers such as high altitude and water to stop working, and evacuate the workers in dangerous areas;

3, cut off the neon signs and dangerous outdoor power supply;

4. Stop open-air collective activities and evacuate people immediately;

Other typhoon blue warning signals.

(3) Typhoon orange warning signal

Icon:

Meaning: it may be affected by a strong tropical storm within 12 hours, with an average wind force of more than 10 or a gust of more than 11; Or have been affected by a strong tropical storm, the average wind force is 10 ~ 11, or the gust is 11 ~ 12 and may continue.

Defense guide:

1. Enter an emergency windproof state, and suggest that primary and secondary schools suspend classes;

2. Residents should not go out at will to ensure that the elderly and children stay in the safest place at home;

3. Relevant emergency departments and emergency rescue units should be on duty, closely monitor the disaster situation and implement countermeasures;

4. Stop large-scale indoor gatherings and evacuate people immediately;

5. Strengthen port facilities to prevent ships from anchoring, grounding and collision;

Other yellow warning signals are the same as typhoon.

(4) Typhoon red warning signal

Icon:

Meaning: It may be or has been affected by typhoon within 6 hours, and the average wind force can reach above 12, or it has reached above 12 and may continue.

Defense guide:

1. It is recommended to suspend business and classes (except for special industries) when entering a special emergency windproof state;

2. Personnel should stay in windproof and safe places as far as possible, and relevant emergency departments and emergency rescue units are ready to start emergency rescue plans at any time;

3. When the typhoon center passes by, the wind will decrease or stay still for a period of time. Remember that the strong wind will suddenly blow and you should continue to stay in a safe place to avoid the wind;

Other orange warning signals of the same typhoon.

Second, the rainstorm warning signal

The rainstorm warning signal is divided into three levels, which are represented by yellow, orange and red respectively. The competent meteorological departments at the provincial level in the northwest and Qinghai-Tibet Plateau can formulate rainstorm warning standards according to the actual situation and report them to the China Meteorological Bureau for approval.

(1) yellow rainstorm warning signal

Icon:

Meaning: The rainfall will reach more than 50 mm in 6 hours, or it has reached more than 50 mm and the rainfall may continue.

Defense guide:

1. Parents, students and schools should pay special attention to weather changes and take defensive measures;

2. Cover the articles for airing in the open air, and relevant units shall do a good job in drainage and flood prevention in low-lying and flood-prone areas;

3. Drivers should pay attention to road water and traffic jams to ensure safety;

4. Check the drainage system of farmland and fish ponds to reduce the water level of easily flooded fish ponds.

(B) rainstorm orange warning signal

Icon:

Meaning: The rainfall will reach more than 50 mm in 3 hours, or it has reached more than 50 mm and the rainfall may continue.

Defense guide:

1. Suspend outdoor operations in open places, and stay indoors or in a safe place to shelter from the rain as much as possible;

2. Relevant emergency departments and rescue units should strengthen their duty, closely monitor the disaster situation, cut off dangerous outdoor power supply in low-lying areas, and implement countermeasures;

3, the traffic management department to deal with water areas to implement traffic guidance or control;

4, the transfer of dangerous areas and dangerous residents to a safe place to shelter from the rain;

Other with yellow rainstorm warning signal.

(3) Rainstorm red warning signal

Icon:

Meaning: The rainfall in 3 hours will reach more than 100 mm, or it has reached more than 100 mm and the rainfall may continue.

Defense guide:

1, personnel should stay in a safe place, outdoor personnel should immediately to a safe place for temporary shelter;

2. Relevant emergency departments and emergency rescue units are ready to start the emergency rescue plan at any time;

3. Schools, kindergartens and other relevant units with existing students and workers should take special protective measures, and units in dangerous areas should suspend classes or business and immediately move to safe places for temporary shelter;

Other rainstorm orange warning signals.

Third, the high temperature warning signal

The high temperature warning signal is divided into two levels, which are represented by orange and red respectively. The competent meteorological departments at the provincial level in arid areas may formulate high-temperature early warning standards according to the actual situation and report them to the China Meteorological Bureau for approval.

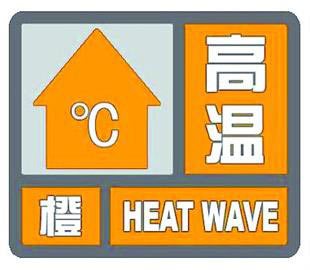

(A) high temperature orange warning signal

Icon:

Meaning: The maximum temperature will rise above 37℃ within 24 hours.

Defense guide:

1. Try to avoid outdoor activities at high temperature in the afternoon, provide heatstroke prevention and cooling guidance to the old, weak, sick and young people, and take necessary protective measures;

2, the relevant departments should pay attention to prevent fires caused by excessive electricity consumption, wires, transformers and other power equipment load;

3. Operators working outdoors or under high temperature conditions shall take necessary protective measures;

4. Pay attention to work and rest time, ensure sleep, and prepare some commonly used heatstroke prevention and cooling drugs when necessary;

5, the media should strengthen the propaganda of heatstroke prevention and cooling health care knowledge, all relevant departments and units to implement heatstroke prevention and cooling safeguard measures.

(2) High temperature red warning signal

Icon:

Meaning: The maximum temperature will rise above 40℃ within 24 hours.

Defense guide:

1. Pay attention to heatstroke prevention and cooling, and minimize outdoor activities during the day;

2, the relevant departments should pay special attention to fire prevention;

3. It is suggested to stop outdoor open-air operations;

Other orange warning signals with high temperature.

Fourth, the cold wave warning signal

The cold wave warning signal is divided into three levels, which are represented by blue, yellow and orange respectively. The gale standard in the cold wave warning standard, the competent meteorological departments at the provincial level can be formulated according to the actual situation with reference to the following standards, and reported to the China Meteorological Bureau for approval.

(A) cold wave blue warning signal

Icon:

Meaning: within 24 hours, the minimum temperature will drop by more than 8℃, the minimum temperature will be less than or equal to 4℃, and the average wind power will reach more than 6, or the gust will be more than 7; Or it has dropped by more than 8℃, the lowest temperature is less than or equal to 4℃, the average wind force is above 6, or the gust is above 7, and it may continue.

Defense guide:

1, personnel should pay attention to add clothes to keep warm, tropical crops and aquaculture varieties should take certain cold and windproof measures;

2. Fasten the doors and windows, coamings, scaffolding, temporary structures and other structures that are easily blown by strong winds, and properly arrange outdoor items that are easily affected by cold waves and strong winds;

3. The ship should take shelter from the wind in a sheltered place, and notify outdoor operators such as high altitude and water to stop working;

4. Pay attention to the latest information about the cooling of strong winds reported by the media, so as to take further measures;

5. Be prepared for cold wave and windy weather in production.

(2) Cold wave yellow warning signal

Icon:

Meaning: within 24 hours, the minimum temperature will drop by more than 12℃, the minimum temperature will be less than or equal to 4℃, and the average wind power will reach more than 6 or the gust will be more than 7; Or it has dropped by more than 12℃, the lowest temperature is less than or equal to 4℃, the average wind force is above 6, or the gust is above 7, and it may continue.

Defense guide:

1, to do a good job of personnel (especially the old and weak patients) cold warm and windproof;

2, do a good job of livestock and poultry cold and wind, tropical and subtropical fruits and related aquatic products, crops and other breeding varieties to take cold and wind measures;

Other blue warning signals of the same cold wave.

(3) Cold wave orange warning signal

Icon:

Meaning: within 24 hours, the minimum temperature will drop by more than 16℃, the minimum temperature will be less than or equal to 0℃, and the average wind power will reach more than 6 or the gust will be more than 7; Or it has dropped by more than 16℃, the lowest temperature is less than or equal to 0℃, the average wind force is above 6, or the gust is above 7, and it may continue.

Defense guide:

1, strengthen personnel (especially the old and weak patients) cold warm and windproof work;

2. Further improve the cold, warmth and wind protection of livestock and poultry;

3. Agriculture, aquaculture and animal husbandry should actively take measures to prevent frost, freezing and strong winds to minimize losses;

Other yellow warning signals with cold wave.

Five, fog warning signal

The fog warning signal is divided into three levels, which are represented by yellow, orange and red respectively.

(1) Fog yellow warning signal

Icon:

Meaning: Dense fog with visibility less than 500 meters may appear within 12 hours, or dense fog with visibility less than 500 meters and greater than or equal to 200 meters has already appeared and may continue.

Defense guide:

1. Drivers should pay attention to the change of dense fog and drive carefully;

2. Pay attention to traffic safety at airports, highways and ferry terminals.

(2) Fog orange warning signal

Icon:

Meaning: Dense fog with visibility less than 200 meters may appear within 6 hours, or dense fog with visibility less than 200 meters and greater than or equal to 50 meters has already appeared and may continue.

Defense guide:

1. Dense fog significantly reduces the air quality, so residents need proper protection;

2. Due to the low visibility, drivers should control the speed to ensure safety;

3, airports, highways, ferry terminals to take measures to ensure traffic safety.

(3) Fog red warning signal

Icon:

Meaning: Strong fog with visibility less than 50 meters may appear within 2 hours, or strong fog with visibility less than 50 meters has already appeared and may continue.

Defense guide:

1. Airports in areas affected by strong fog have suspended the take-off and landing of aircraft, and highways and ferries have been temporarily closed or suspended;

2, all kinds of motor vehicles to take effective measures to ensure safety.

Six, thunderstorm gale warning signal

Thunderstorm and gale warning signals are divided into four levels, which are represented by blue, yellow, orange and red respectively.

(1) Blue warning signal of thunderstorm and gale

Icon:

Meaning: It may be affected by thunderstorms and strong winds within 6 hours, and the average wind force can reach above 6, or the gust is above 7 accompanied by lightning; Or it has been affected by thunderstorms and strong winds, and the average wind force has reached 6-7, or the gust is 7-8 accompanied by lightning, and it may continue.

Defense guide:

1. Prepare for wind and lightning protection;

2. Pay attention to the latest news about thunderstorms and strong winds reported by the media and the notice about wind prevention, so that students stay in a safe place;

3, the doors and windows, hoardings, scaffolding, temporary structures and other structures easily blown by the wind, personnel should leave the temporary structures as soon as possible, and properly arrange outdoor items that are easily affected by thunderstorms and strong winds.

(2) Yellow warning signal of thunderstorm and gale

Icon:

Meaning: It may be affected by thunderstorms and strong winds within 6 hours, with an average wind force of more than 8, or a gust of more than 9 accompanied by strong lightning; Or have been affected by thunderstorms and strong winds, with an average wind force of 8-9, or gusts of 9-10 accompanied by strong lightning, and may continue.

Defense guide:

1. Keep the valuable electrical equipment vulnerable to lightning properly, and put it in a safe place after power failure;

2. Residents in dangerous areas and dangerous buildings, as well as ships, should take shelter from the wind in sheltered places. Never take shelter from the rain under trees, poles or tower cranes. When there is lightning, you should turn off your mobile phone.

3, cut off the neon signs and dangerous outdoor power supply;

4. Stop open-air collective activities and evacuate people immediately;

5, high altitude, water and other outdoor workers to stop work, the danger zone personnel evacuation;

Other blue warning signals for thunderstorms and strong winds.

(3) orange warning signal of thunderstorm and gale

Icon:

Meaning: It may be affected by thunderstorms and strong winds within 2 hours, with an average wind force of more than 10 or a gust of more than 11, accompanied by strong lightning; Or have been affected by thunderstorms and strong winds, with an average wind force of 10-11, or gusts of 11-12 accompanied by strong lightning, and may continue.

Defense guide:

1. Personnel shall not go out and ensure to stay in the safest place;

2. Relevant emergency departments and emergency rescue units are ready to start the emergency rescue plan at any time;

3. Strengthen port facilities to prevent ships from anchoring and collision;

Other yellow warning signals for thunderstorms and strong winds.

(4) Thunderstorms and strong winds in red warning signal

Icon:

Meaning: It may be affected by thunderstorms and strong winds within 2 hours, and the average wind force can reach above 12 with strong lightning; Or have been affected by thunderstorms and strong winds, with an average wind force of more than 12 and strong lightning, and may continue.

Defense guide:

1. Enter a particularly emergency windproof state;

2. Relevant emergency departments and emergency rescue units are ready to start the emergency rescue plan at any time;

Other orange warning signals for thunderstorms and strong winds.

Seven, strong wind warning signal

The warning signal of gale (except typhoon, thunderstorm and gale) is divided into four levels, which are represented by blue, yellow, orange and red respectively.

(A) gale blue warning signal

Icon:

Meaning: It may be affected by strong winds within 24 hours, with an average wind force of more than 6 or a gust of more than 7; Or have been affected by strong winds, the average wind force is 6-7, or the gust is 7-8 and may continue.

Defense guide:

1. Prepare for windproof;

2. Pay attention to the latest news about the gale reported by the media and the notice about wind prevention;

3, the doors and windows, hoardings, scaffolding, temporary structures and other structures that are easily blown by the wind, and properly arrange outdoor items that are easily affected by strong winds.

(2) Gale yellow warning signal

Icon:

Meaning: It may be affected by strong winds within 12 hours, with an average wind force of more than 8 or a gust of more than 9; Or have been affected by strong winds, the average wind force is 8-9, or the gust is 9-10 and may continue.

Defense guide:

1. It is recommended to suspend classes in kindergartens and nurseries when entering the windproof state;

2, close the doors and windows, dangerous areas and dangerous residents and ships should take shelter from the wind, and notify outdoor workers such as high altitude and water to stop working;

3, cut off the neon signs and dangerous outdoor power supply;

4. Stop open-air collective activities and evacuate people immediately;

Other blue warning signals with strong wind.

(3) Gale orange warning signal

Icon:

Meaning: It may be affected by strong winds within 6 hours, with an average wind force of more than 10 or a gust of more than 11; Or have been affected by strong winds, the average wind force is 10-11, or the gust is 11-12 and may continue.

Defense guide:

1. Enter an emergency windproof state, and suggest that primary and secondary schools suspend classes;

2. Residents should not go out at will to ensure that the elderly and children stay in the safest place at home;

3. Relevant emergency departments and emergency rescue units should be on duty, closely monitor the disaster situation and implement countermeasures;

4. Strengthen port facilities to prevent ships from anchoring and colliding;

Other yellow warning signals with strong wind.

(4) Gale red warning signal

Icon:

Meaning: There may be a gale with an average wind force of more than 12 within 6 hours, or there has been a gale with an average wind force of more than 12 and it may continue.

Defense guide:

1. It is recommended to suspend business and classes (except for special industries) when entering a special emergency windproof state;

2. Personnel should stay in windproof and safe places as far as possible, and relevant emergency departments and emergency rescue units are ready to start emergency rescue plans at any time;

Other orange warning signals with strong wind.

Eight, sandstorm warning signal

The warning signal of sandstorm is divided into three levels, which are represented by yellow, orange and red respectively.

(A) the yellow warning signal of sandstorm

Icon:

Meaning: sandstorm weather may occur within 24 hours (visibility is less than 1000 meters) or sandstorm weather has occurred and may continue.

Defense guide:

1. Prepare for wind and sand prevention, and close the doors and windows in time;

2, pay attention to carry masks, scarves and other dust supplies, so as to avoid dust damage to the eyes and respiratory tract; Do a good job of sealing precision instruments;

3. Fasten the structures that are easily blown by the wind, such as hoardings, scaffolding and temporary structures, and properly arrange outdoor items that are easily affected by sandstorms.

(B) Strong sandstorm orange warning signal

Icon:

Meaning: Strong sandstorm weather may occur within 12 hours (visibility is less than 500 meters), or it has already occurred and may continue.

Defense guide:

1. Pedestrians who cover their heads with gauze to defend against sandstorms should ensure good sight and pay attention to traffic safety;

2. Pay attention to riding bicycles as little as possible, and don’t stay on billboards, temporary structures and old trees when it is windy; Drivers should pay attention to the change of sandstorm and drive carefully;

3. Pay attention to traffic safety at airports, highways and ferry terminals;

4, all kinds of motor vehicles to take effective measures to ensure safety;

Other yellow warning signals of sandstorm.

(3) Extremely strong sandstorm in red warning signal.

Icon:

Meaning: Extreme sandstorm weather may occur within 6 hours (visibility is less than 50 meters), or it has already occurred and may continue.

Defense guide:

1, personnel should stay in a windproof and safe place, don’t outdoor activities; Postpone going to school or leaving school until the end of the particularly strong sandstorm;

2. Relevant emergency departments and emergency rescue units are ready to start the emergency rescue plan at any time;

3. Airports in areas affected by extremely strong sandstorms are suspended from taking off and landing, and highways and ferries are temporarily closed or suspended;

Others are the same as the orange warning signal of sandstorm.

Nine, hail warning signal

Hail warning signals are divided into two levels, which are represented by orange and red respectively.

(1) Hail orange warning signal

Icon:

Meaning: there may be hail accompanied by lightning weather within 6 hours, and it may cause hail disaster.

Defense guide:

1, pay attention to the weather changes, prepare for hail suppression and lightning protection;

2, proper placement of outdoor items, cars, etc., which are easily affected by hail;

3. Old people and children should not go out and stay at home;

4. Drive poultry and livestock to a safe place with a canopy;

5. Don’t enter isolated shacks, sentry boxes and other buildings or under big trees, and turn off your mobile phone when there is lightning;

6. Prepare for the operation of artificial hail suppression and wait for an opportunity to carry out artificial hail suppression.

(2) Hail red warning signal

Icon:

Meaning: There is a great possibility of hail accompanied by lightning weather within 2 hours, and it may cause heavy hail disaster.

Defense guide:

1, outdoor pedestrians immediately to a safe place for temporary shelter;

2. Relevant emergency departments and emergency rescue units are ready to start the emergency rescue plan at any time;

Other hail orange warning signals.

Ten, snow disaster warning signal

Snow disaster warning signals are divided into three levels, which are represented by yellow, orange and red respectively.

(A) Snowstorm Yellow Warning Signal

Icon:

Meaning: There may be snowfall that has an impact on traffic or animal husbandry within 12 hours.

Defense guide:

1, the relevant departments to prepare for snow;

2. The transportation department should prepare for road snow melting;

3, agricultural and pastoral areas to prepare food and grass.

(B) Snowstorm orange warning signal

Icon:

Meaning: There may be snowfall that has a great impact on traffic or animal husbandry within 6 hours, or there has been snowfall that has a great impact on traffic or animal husbandry and may continue.

Defense guide:

1, the relevant departments to do a good job of road cleaning and snow melting;

2. Drivers should drive carefully to ensure safety;

3. Drive the wild livestock into the pen to feed;

Other yellow warning signals of the same snowstorm.

(3) Snowstorm in red warning signal

Icon:

Meaning: within 2 hours, there may be snowfall that has a great impact on traffic or animal husbandry, or there has been snowfall that has a great impact on traffic or animal husbandry and may continue.

Defense guide:

1. Close road traffic when necessary;

2. Relevant emergency departments are ready to start the emergency plan at any time;

3. Do a good job in disaster relief in pastoral areas;

Other orange warning signals of the same snowstorm.

Eleven, road icing warning signal

The warning signal of road icing is divided into three levels, which are represented by yellow, orange and red respectively.

(A) road icing yellow warning signal

Icon:

Meaning: There may be road icing that has an impact on traffic within 12 hours.

Defense guide:

1, transportation, public security and other departments should do a good job in preparation;

2. Drivers should pay attention to road conditions and exercise safely.

(B) Road icing orange warning signal

Icon:

Meaning: There may be road icing that has a great impact on traffic within 6 hours.

Defense guide:

1. Pedestrians should pay attention to anti-skid when going out;

2, public security departments pay attention to command and guide the exercise of vehicles;

3. Drivers should take anti-skid measures, obey orders and exercise slowly;

Other yellow warning signals for icing on the same road.

(3) Road icing red warning signal

Icon:

Meaning: There may be or has been road icing that has a great impact on traffic within 2 hours.

Defense guide:

1, the relevant emergency departments ready to start the emergency plan;

2. Close icy road traffic when necessary;

Other orange warning signals for icing on the same road.

|

|