Government office [2022〕105number

Chengkou county people’s government office

About printing and distributing "Emergency Plan for Natural Disaster Relief in Chengkou County》

Notice of

Township people’s governments, sub-district offices, county government departments and relevant units:

The Emergency Plan for Natural Disaster Relief in Chengkou County has been approved by the county government and is hereby printed and distributed to you, please implement it carefully.

Chengkou county people’s government office

July 28, 2022

Emergency Plan for Natural Disaster Relief in Chengkou County

eyerecord

1 General 1

1.1 Compilation Purpose 1

1.2 Compilation Basis 1

1.3 Scope of application 1

1.4 Working Principle 2

2 Organization and command system 3

2.1 County Natural Disaster Emergency Headquarters 3

2.2 Main responsibilities of member units 3

2.3 Township (street) natural disaster relief agencies 9

2.4 linkage mechanism 9

2.5 Field Level 10

2.6 Expert Group 10

3 Disaster early warning response 11

3.1 Early Warning Information Release 11

3.2 Early Warning Response Assessment and Start-up 11

3.3 Early warning response measures 11

3.4 Early Warning Response Termination 12

4 Disaster information report and release 13

4.1 Disaster Information Report 13

4.2 Disaster information release 15

5 Emergency response 16

5.1 Class I response 16

5.2 Level Ⅱ response 19

5.3 Class III Response 23

5.4 Level IV Response 26

5.5 Adjustment of Starting Conditions 28

5.6 Response Termination 29

6 Post-disaster relief 30

6.1 transitional life assistance 30

6.2 Restoration and reconstruction of damaged houses 30

6.3 winter and spring assistance 31

7 Safeguards 33

7.1 Financial guarantee 33

7.2 Material support 33

7.3 Communication and information security 33

7.4 Equipment and equipment support 33

7.5 Human resources protection 34

7.6 Social mobilization guarantee 34

7.7 Publicity, training and drills 34

8 supplementary provisions 36

8.1 Interpretation of Terms 36

8.2 Plan management 36

8.3 Plan Interpretation 36

8.4 Plan implementation 36

9 Appendix 37

9.1 Chengkou County Natural Disaster Emergency Relief Duty Telephone 37

9.2 Chengkou County Natural Disaster Emergency Relief Duty Telephone 38

9.3 Contact telephone number of county emergency relief materials storage and disaster relief donations 39

9.4 county relief materials ledger (2022 statistics) 39

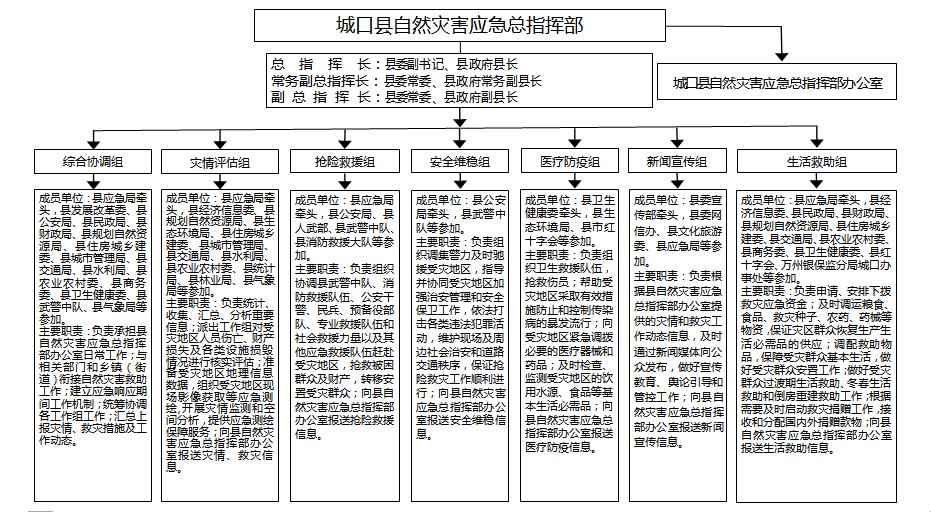

9.5 Emergency Command Framework of Natural Disaster Relief in Chengkou County Figure 40

one general rules

1.1 Purpose of compilation

Guided by the Supreme Leader’s Socialism with Chinese characteristics Thought in the New Era, thoroughly implement the important exposition spirit of the Supreme Leader’s General Secretary on disaster prevention, mitigation and relief, conscientiously implement the decision-making arrangements of the CPC Central Committee and the State Council, adhere to the people first and life first according to the work requirements of the municipal party committee and government, establish and improve the rescue system and operation mechanism for sudden natural disasters in Chengkou County, standardize emergency rescue behavior, improve emergency rescue ability, minimize casualties and property losses, ensure the basic livelihood of the affected people, and maintain social stability in the affected areas.

1.2 Compilation basis

According to People’s Republic of China (PRC) Emergency Response Law, People’s Republic of China (PRC) Flood Control Law, People’s Republic of China (PRC) Earthquake Prevention and Disaster Reduction Law, People’s Republic of China (PRC) Forest Law, Natural Disaster Relief Regulations, Geological Disaster Prevention Regulations, National Emergency Plan for Natural Disaster Relief, Chongqing Emergency Response Regulations, Chongqing Geological Disaster Prevention Regulations, Chongqing Emergency Warning Information Release Management Measures, Chongqing Emergency Plan Management Implementation Measures, Chongqing Natural Disaster Relief Emergency Plan, Chengkou County Comprehensive Emergency Plan, Notice of Chengkou County People’s Government Office on Adjusting the Composition and Personnel of Chengkou County Safety Production Committee and Chengkou County Disaster Reduction Committee, and other laws, regulations and relevant documents, this plan is formulated.

1.3 Scope of application

This plan is applicable to the county-level emergency rescue work when natural disasters occur within the administrative area of Chengkou County.

When serious natural disasters occur in the adjacent areas and have a significant impact on Chengkou County or the county party committee and county government make deployment requirements, emergency rescue work shall be carried out according to this plan.

Accidents, disasters, public health incidents, social security incidents and other emergencies, resulting in a large number of casualties and property losses, need the government to urgently transfer resettlement or life assistance, according to the needs, you can refer to this plan to carry out emergency rescue work.

1.4 working principles

(1) Adhere to the people first and life first, and ensure the basic livelihood of the affected people.

(2) Adhere to prevention first and incorporate natural disaster emergency rescue into daily management.

(3) Adhere to unified leadership, comprehensive coordination, graded responsibility and territorial management.

(4) Adhere to the leadership of the Party committee, government-led, social participation and mass self-help, and give full play to the role of grassroots mass autonomous organizations and public welfare social organizations.

(5) Adhere to the integration of disaster prevention, rescue and disaster relief, and realize the whole process management of disasters.

2 Organization and command system

2.1 County Natural Disaster Emergency Headquarters

County Disaster Reduction Committee (county natural disaster emergency headquarters) is the comprehensive coordination agency for natural disaster relief in the county, and is responsible for organizing and leading the natural disaster relief work in the county. The member units of the county natural disaster emergency headquarters shall do a good job in natural disaster relief according to their respective responsibilities.

Commander-in-Chief: Deputy Secretary of the county party committee and county magistrate.

Executive Deputy Commander-in-Chief: Standing Committee of the County Party Committee and Executive Deputy County Magistrate of the County Government.

Deputy commander-in-chief: member of the Standing Committee of the county party committee and deputy magistrate of the county government.

Members: the director of the county government office and relevant deputy directors; The main person in charge of county economic information committee, county planning and natural resources bureau, county water conservancy bureau, county agricultural and rural committee, county emergency bureau, county forestry bureau and county meteorological bureau; County Party Committee Propaganda Department, County Party Committee Network Information Office, County Development and Reform Commission, County Education Commission, County Public Security Bureau, County Civil Affairs Bureau, County Judicial Bureau, County Finance Bureau, County Ecological Environment Bureau, County Housing and Urban-Rural Construction Committee, County Transportation Bureau, County Commercial Committee, County Cultural Tourism Committee, County Health and Wellness Committee, County Statistics Bureau, County People’s Armed Forces Department, County Armed Police Squadron, Communist Youth League Committee, County Association for Science and Technology, County Red Cross Society, Chengkou Administrative School, Wanzhou Banking Insurance Supervision.

County Disaster Reduction Committee (county natural disaster emergency headquarters) office is located in the county emergency bureau, responsible for the daily work of the county disaster reduction Committee (county natural disaster emergency headquarters). The main person in charge of the county emergency bureau concurrently serves as the director of the office, and the person in charge concurrently serves as the deputy director of the office.

2.2 Main responsibilities of member units

Propaganda Department of the County Party Committee: responsible for organizing and coordinating the media to do a good job in news reporting, policy interpretation and public welfare propaganda of disaster prevention, mitigation and relief work; Do a good job in publicity and education of disaster prevention knowledge and timely dissemination of disaster early warning information; Responsible for timely and correct guidance of public opinion.

Network Information Office of the County Party Committee: responsible for coordinating and guiding the guidance and disposal of public opinion on disaster prevention and mitigation networks.

County Development and Reform Commission: responsible for balancing natural disaster prevention and control projects with national economic and social development plans, three-year rolling government investment plans and annual investment plans; Responsible for actively seeking special funds for central disaster relief and post-disaster recovery and reconstruction; Take the lead in organizing the planning of post-disaster recovery and reconstruction of natural disasters.

County Education Committee: responsible for organizing and guiding schools to do a good job in publicity and education of disaster prevention, mitigation and relief knowledge and prevention and control of natural disasters; To guide the education departments in the disaster-stricken areas to do a good job in the emergency transfer and resettlement of students and faculty in the disaster-stricken schools; Take effective measures to restore normal teaching order in time.

County Economic Information Committee: responsible for guiding the assessment of natural disaster risk impact in industrial planning, industrial layout planning and industrial project construction; Implement policies such as exempting natural disaster early warning, special radio frequency occupation fee for emergency rescue and disaster relief; Coordinate the emergency support of industrial products related to natural disasters, and organize the emergency call of county-level medical reserves; Guide the disaster prevention, mitigation and relief work of industrial enterprises within the responsibility of safety supervision in disaster areas. Organize and coordinate emergency rescue communications and other important communications to ensure the network operation safety of the public information network in disaster areas; Responsible for guiding telecom operators to do a good job in meteorological defense of communication facilities and ensuring the smooth flow of early warning information channels for emergencies.

County Public Security Bureau: responsible for natural disaster rescue and traffic order maintenance, public security management and security work; Maintain public order in disaster areas, and assist in organizing people in disaster areas to urgently transfer to avoid danger; Do a good job in investigating and handling illegal and criminal cases related to natural disasters.

County Civil Affairs Bureau: responsible for supporting and guiding social forces such as disaster social workers to participate in emergency rescue and disaster relief, disaster relief donations, etc., and urging and guiding all localities to include qualified disaster victims in the scope of temporary assistance or minimum living security in a timely manner; Do a good job in the funeral of the victims of the disaster; Advocate civilized sacrifice to reduce the risk of forest and grassland fire.

County Finance Bureau: responsible for organizing and arranging the budget for natural disaster prevention and control, and actively seeking the support of municipal disaster relief funds with the natural disaster prevention department; According to the natural disaster prevention and control department’s arrangement plan for county-level disaster relief funds, timely allocate disaster relief funds.

County Planning and Natural Resources Bureau: responsible for organizing the preparation of geological disaster prevention planning and protection standards and guiding their implementation; Organize, guide, coordinate and supervise the investigation and evaluation of geological disasters and the general survey, detailed investigation and investigation of hidden dangers; Guide the development of group monitoring and prevention, professional monitoring and forecasting and early warning. To guide the engineering management of geological disasters; To undertake technical support for emergency rescue of geological disasters; Incorporate forest fire prevention infrastructure construction and earthquake and geological disaster prevention and mitigation into national spatial planning; Organize the prevention and control of geological disasters caused by meteorological conditions; Jointly carry out meteorological forecast and early warning of geological disasters in the county.

County Ecological Environment Bureau: responsible for assisting relevant departments to investigate and deal with sudden environmental pollution incidents caused by natural disasters, carry out environmental monitoring during the disaster period, put forward pollution control measures, and timely release relevant environmental information; In conjunction with relevant departments, do a good job in environmental monitoring and supervision of drinking water sources in disaster areas and guide the environmental protection of drinking water sources; Joint meteorological departments to carry out heavy pollution weather consultation and air quality forecast.

County Housing and Urban-Rural Construction Committee: responsible for guiding the disaster-stricken areas to carry out safety appraisal and repair of houses damaged by disasters, and implementing project quality supervision; Guide and supervise the prevention and control of natural disasters in the construction site of houses and municipal infrastructure projects under construction in the county; Organize and guide the investigation, monitoring and rectification of hidden dangers of geological disasters caused by housing construction and municipal infrastructure projects; Organize and guide the prevention and control of meteorological disasters in housing construction and municipal engineering.

County Transportation Bureau: responsible for organizing and coordinating emergency transportation capacity, and cooperating with relevant departments to transport rescue and relief personnel, relief materials and affected people; Organize the repair of highway facilities damaged during the disaster, and give priority to rushing through traffic routes.

County Water Conservancy Bureau: responsible for organizing the preparation of flood and drought disaster prevention planning and protection standards and guiding their implementation; To undertake the monitoring and early warning of water regime and drought; Organize the preparation of flood prevention and emergency water dispatching schemes for important rivers, lakes and important water projects, submit them for approval according to procedures and organize their implementation; To undertake technical support for flood prevention and emergency rescue. Organize and implement the prevention and control of mountain torrents and the restoration of water conservancy and water damage projects; Guide and urge the relevant towns (streets) to do a good job in reservoir water storage safety prevention; Organize and coordinate the overall protection of life, production and management and ecological environment water use in the affected areas.

County Agricultural and Rural Committee: responsible for guiding the prevention of meteorological disasters in agricultural production, the publicity and education of farmers’ safe use of fire in the field, and strengthening the management and control of fire in agricultural production; Formulate and implement the principles and policies of agricultural science and technology to prevent floods and droughts, and guide the establishment of the county-wide agricultural flood control, drought prevention and mitigation technical service system; Statistical report on agricultural damage in the county; Organize the storage and allocation of emergency relief materials for animal epidemic prevention, such as seeds, animal vaccine disinfection drugs, emergency disposal and protection, and guide the recovery of production after the disaster.

County Commercial Committee: responsible for guiding the disaster prevention, mitigation and relief work of commercial enterprises and organizing and coordinating commercial enterprises to participate in emergency rescue; Organize and coordinate the supply of emergency living materials, use reserve materials according to procedures, and stabilize market supply; Assist in organizing natural disaster rescue related materials.

County Cultural Tourism Committee: responsible for coordinating the prevention and control of natural disasters in tourist attractions, emergency rescue and disposal of sudden disasters, and rescue and relief of cultural relics tourist attractions; Cooperate with relevant departments to guide and supervise the implementation of forest and grassland fire prevention and control measures in tourist attractions; Guide and urge tourism enterprises to do a good job in the dissemination of meteorological disaster early warning information, the transfer and evacuation of tourists and other safety and avoidance work.

County Health and Wellness Committee: responsible for organizing and guiding medical institutions to carry out the prevention and control of natural disasters, allocating medical and health resources, setting up a professional technical team for health emergency, and going to the scene and disaster areas in time to carry out health emergency work such as medical treatment, disease prevention and control, and psychological rescue as needed; Strengthen the supervision of drinking water hygiene in disaster areas; Responsible for the dispatch of personnel, vehicles and equipment of the health emergency team; Promote the restoration and reconstruction of health infrastructure; The joint meteorological department issued a warning of high temperature heatstroke; Statistical report on the disaster situation in the health field of the county.

County Emergency Bureau: responsible for the daily work of county natural disaster emergency headquarters office, county forest and grassland fire prevention headquarters office, county flood control and drought relief headquarters office, county geological disaster prevention and rescue headquarters office and county earthquake relief headquarters office; Organize the preparation of special plans for natural disasters in the county, comprehensively coordinate the connection of emergency plans, and organize pre-plan drills. According to the principle of graded responsibility, to guide the emergency rescue of natural disasters; Organize and coordinate the emergency rescue work for major disasters and make decisions according to the authority; To undertake the work of the headquarters for dealing with major disasters, and assist the responsible comrades of the county party committee and the county government in organizing the emergency response work for major disasters. Organize the preparation of comprehensive disaster prevention and mitigation plans, and guide and coordinate the prevention and control of natural disasters in relevant departments; In conjunction with relevant departments, establish a unified emergency management information platform, establish a monitoring and early warning and disaster reporting system, improve the acquisition and sharing mechanism of natural disaster information resources, and uniformly publish disasters according to law. Carry out comprehensive monitoring and early warning of multi-disaster types and disaster chains, and guide the comprehensive risk assessment of natural disasters.

County Statistics Bureau: responsible for guiding the disaster statistics business.

County Forestry Bureau: responsible for organizing the preparation of forest and grassland fire prevention planning and protection standards and guiding their implementation; Guide to carry out fire patrol, fire source management, fire prevention facilities construction and other work; Organize and carry out publicity and education, monitoring and early warning, supervision and inspection of forest and grassland fire prevention; Responsible for forest and grassland fire prevention, early warning and monitoring related work; Organize and guide state-owned forest farms and grasslands to carry out forest fire prevention publicity and education, monitoring and early warning, supervision and inspection; Assist in forest and grassland fire fighting; Supervise and guide the ecological restoration of forests and grasslands after the disaster.

County People’s Armed Forces Department: responsible for organizing militia to participate in emergency rescue and disaster relief; Guide the township (street) people’s armed forces department to systematically organize militia to carry out natural disaster rescue work.

County Meteorological Bureau: responsible for the daily work of the county meteorological disaster prevention headquarters office, organizing, coordinating, guiding and supervising the county-wide meteorological disaster prevention work; Do a good job in weather and climate monitoring, forecasting, early warning and information release, and provide meteorological service information; Organize the assessment of major meteorological disasters to provide decision-making basis for the prevention of meteorological disasters; Coordinate and promote the construction and operation management of the county’s emergency early warning information release platform.

County fire rescue brigade: responsible for giving full play to the role of the main force of emergency rescue, and organizing fire rescue teams to participate in the rescue of natural disasters such as forest and grassland fire fighting, earthquake and geological disasters, floods and droughts; Actively do a good job in personnel search and rescue and transfer of trapped personnel.

Chengkou Supervision Group of Wanzhou Banking Insurance Supervision Branch: responsible for urging banking financial institutions and insurance financial institutions to implement emergency business plans during the occurrence and duration of disasters; Supervise and guide policy-oriented agricultural insurance, rural housing insurance and other service institutions to timely standardize and do a good job in survey claims and fund payment; Coordinate the promotion of catastrophe insurance and establish a disaster relief insurance system.

State Grid Chengkou Power Supply Company: responsible for emergency rescue and disaster relief power supply and power safety. Responsible for organizing the maintenance of power supply facilities in disaster areas within the administrative area and the repair and restoration of damaged facilities, and restoring power supply in time.

2.3 Township (street) natural disaster relief agencies

Each township (street) should set up an emergency command organization for natural disaster relief. When a natural disaster occurs in this administrative area, the relevant person in charge of the township (street) will rush to the scene to check the disaster situation and carry out early emergency relief; Timely organize forces to urgently transfer and resettle the affected people. The office of the county natural disaster emergency headquarters strengthened work guidance and technical support.

2.4 linkage mechanism

When it is predicted that a major or especially major disaster will occur, according to the instructions of the County Disaster Reduction Committee, the office of the county natural disaster emergency headquarters will coordinate all member units and relevant towns (streets) to make various preparations for disaster relief.

According to the actual disaster relief work, directly under the authority, enterprises and institutions need to provide help and support, and the county natural disaster emergency headquarters office will coordinate and handle it.

Other relevant departments and units shall, according to the needs of disaster relief, actively provide favorable conditions and cooperate with the completion of disaster relief tasks.

2.5 Field level

When a natural disaster occurs, the county natural disaster emergency headquarters set up a natural disaster site emergency headquarters, which is responsible for organizing and leading the natural disaster relief work within its administrative area, and set up special working groups such as comprehensive coordination, disaster assessment, emergency rescue, security and stability, medical and epidemic prevention, news propaganda and life assistance. The units and personnel involved in the on-site emergency rescue should obey the unified leadership of the on-site emergency headquarters.

2.6 Expert Group

Under the leadership of the county natural disaster emergency headquarters, an emergency management expert team will be set up to provide policy advice and suggestions for major decisions and important plans of disaster prevention, mitigation and relief work in the county, and to provide advice for disaster assessment, emergency rescue and post-disaster relief of natural disasters in the county.

three Disaster early warning response

3.1 Early warning information release

County meteorological bureau, county water conservancy bureau, county forestry bureau, county planning and natural resources bureau and other departments should strengthen the monitoring and forecasting of natural disasters; Timely notify the county natural disaster emergency rescue unit of the early warning and forecasting information of natural disasters, and timely release the early warning information in accordance with the relevant provisions of the Measures for the Administration of Early Warning Information Release of Emergencies in Chongqing (No.31 [2011] of Yu Fu Fa).

3.2 Early Warning Response Assessment and Start-up

Relevant departments and units of the township (street) and county governments should organize relevant departments and institutions, professional and technical personnel and experts according to the early warning and forecasting information of natural disasters, and make timely analysis and judgment in combination with the natural conditions, population and socio-economic conditions of the areas that may be affected, make a pre-assessment of the possible disasters, and start early warning response when there is a possibility of threatening people’s lives and property safety and affecting their basic lives and needing to take countermeasures in advance.

3.3 Early warning response measures

After the early warning response is started, the office of the county natural disaster emergency headquarters can take one or more of the following measures as appropriate:

(1) to inform the member units and towns (streets) that may be affected of the early warning information and put forward the requirements for disaster relief preparations.

(2) Strengthen emergency watch, closely follow the change and development trend of disaster risk, dynamically evaluate the possible losses caused by disasters, adjust relevant measures in time, and make all preparations for starting emergency response.

(3) Send an early warning and response working group to learn about disaster risks on the spot and inspect and guide various disaster relief preparations.

(4) Report the start of early warning response to the county government; Inform the member units to prepare for disaster relief.

(5) release the start of early warning response to the society.

3.4 Early warning response terminated

After the disaster risk is released or evolved into a disaster, the unit that issued the early warning response will terminate the early warning response.

four Disaster information report and release

4.1 Disaster information report

4.1.1 Main contents of disaster report

The time, place and background of the disaster, the losses caused by the disaster (people affected, the number of casualties, crops affected, houses collapsed and damaged, direct economic losses caused, etc.), the rescue measures taken and the rescue needs of the disaster areas.

4.1.2 Statistics of natural disasters

According to the Regulations on Natural Disaster Relief in the State Council and the Statistical System of Natural Disasters approved by the National Bureau of Statistics, the county natural disaster emergency headquarters office and the county emergency bureau organize, coordinate and manage the statistical work of natural disasters. The number of deaths due to disasters, the number of emergency resettlement, the number of people lacking food and clothing, the number of damaged houses, the number of people lacking water, and the loss of crops are all based on the statistical data of the county emergency bureau.

4.1.3 Procedures and time limits for disaster information reporting

(1) Preliminary report of disaster: After sudden natural disasters, the affected towns (streets) should report the disaster losses to the relevant departments at the county level and the office of the county natural disaster emergency headquarters within 1 hour; The office of the county natural disaster emergency headquarters should complete the disaster data summary within 2 hours, and report the disaster losses to the county party committee, the county government and the municipal emergency bureau, and report the deaths (including missing) immediately.

(2) Continued disaster reporting: Before the natural disaster situation stabilizes, the emergency management departments of people’s governments at all levels shall implement the 24-hour zero reporting system, and the affected towns (streets) shall report the disaster situation and disaster relief work of the previous day to the office of the county natural disaster emergency headquarters before 12 o’clock every day; The office of the county natural disaster emergency headquarters will report the disaster situation and disaster relief work for 24 hours the day before 14: 00 every day to the Municipal Emergency Bureau.

(3) Disaster report: After the disaster situation is stable, the affected towns (streets) shall verify the disaster situation and disaster relief data and report them to the office of the county natural disaster emergency headquarters within 4 working days; The office of the county natural disaster emergency headquarters shall verify the disaster situation and disaster relief work within 5 days and report to the Municipal Emergency Bureau.

(4) In the event of a drought disaster, the affected villages and towns (streets) should make an initial report when the drought appears and the people’s production and life are affected to some extent; In the process of drought development, it will be reported once every 10 days until the disaster is released and reported for verification.

(5) The county natural disaster emergency headquarters should establish and improve the disaster consultation system, organize relevant departments to hold disaster consultation meetings in time, and comprehensively and objectively evaluate and verify disaster data.

4.1.4 Disaster reporting methods

After the occurrence of natural disasters, the affected towns (streets) choose an appropriate way to report to the county natural disaster emergency headquarters office, and the county natural disaster emergency headquarters office will submit disaster information through the national natural disaster management system network, and report pictures when conditions permit. When the system network is interrupted, it can be submitted in advance by telephone, SMS, fax, etc., and will be supplemented immediately after the network returns to normal. In case of emergency, you can report orally by telephone first, and then report in writing.

4.1.5 After the occurrence of severe and extraordinarily serious disasters, the office of the county natural disaster emergency headquarters keeps in touch with the municipal emergency bureau for 24 hours, and reports the dynamic information of the disaster situation and disaster relief work at any time.

4.2 Disaster information release

The release of disaster information adheres to the principles of seeking truth from facts, timeliness, accuracy, openness and transparency. The forms of disaster information release include authorized release, organizing reports, accepting interviews with reporters, and holding press conferences. To take the initiative to release information through key news websites or government websites, government Weibo, government WeChat, etc.

Before the natural disaster situation is stabilized, the office of the county natural disaster emergency headquarters shall timely release to the society the casualties and property losses caused by natural disasters, as well as the dynamics, effectiveness and next steps of natural disaster relief work; After the natural disaster situation is stable, it should be timely evaluated, approved and released according to the relevant provisions of the natural disaster losses.

If there are other provisions in laws and regulations on the verification and release of disasters, those provisions shall prevail.

five emergency response

According to the harm degree of natural disasters and other factors, the emergency response of natural disaster relief in Chengkou County is divided into four levels: I, II, III and IV.

5.1 Class I response

5.1.1 Starting conditions

A particularly serious natural disaster occurs within the administrative area of Chengkou County, and if one of the following circumstances occurs during a disaster, a Class I response will be initiated:

(1) More than 10 people died;

(2) More than 3,000 people need emergency resettlement or emergency life assistance;

(3) More than 1,000 houses collapsed and seriously damaged;

(4) Drought disasters have caused difficulties in life such as lack of food or water, and more than 3,000 people need government assistance;

(5) The county natural disaster emergency headquarters considers that other situations meet the requirements for starting the level I response and other special natural disaster emergency plans meet the conditions for starting the level I response.

5.1.2 Start-up procedure

After the disaster, the office of the county natural disaster emergency headquarters determined that the disaster reached the start-up standard according to the disaster situation through analysis and evaluation, and put forward a proposal to start the level I response to the county natural disaster emergency headquarters. The commander-in-chief of the county natural disaster emergency headquarters decided to start the level I response and reported it to the county government. When necessary, the county government directly decided to start the level I rescue response.

5.1.3 Response measures

The commander-in-chief of the county natural disaster emergency headquarters or the deputy commander-in-chief appointed by the county natural disaster emergency headquarters shall organize, lead and coordinate the natural disaster relief work at the county level, and guide and support the natural disaster relief work in the affected towns (streets). The county natural disaster emergency headquarters and its member units shall take the following measures as appropriate:

(1) The commander-in-chief of the county natural disaster emergency headquarters or the deputy commander-in-chief appointed by the county natural disaster emergency headquarters presided over a meeting of the Chamber of Commerce, with the participation of all member units, expert groups and affected towns (streets), and made decisions on guiding and supporting major issues in disaster reduction and relief in the affected areas.

(2) the commander-in-chief of the county natural disaster emergency headquarters or the deputy commander-in-chief appointed by the county natural disaster emergency headquarters led the relevant member units to guide the natural disaster relief work in the affected areas; The deputy commander-in-chief of the county natural disaster emergency headquarters (deputy magistrate in charge of production safety) led an early working group composed of relevant member units to the affected areas to guide the natural disaster relief work according to the development of the disaster.

(3) The county natural disaster emergency headquarters office (county emergency bureau) timely grasps the dynamic information of disaster situation and disaster relief work, organizes disaster consultation, and timely releases the needs of the affected areas. Relevant member units should share information about the disaster situation, the needs of the affected areas and the dynamics of disaster relief work, and report the relevant information to the office of the county natural disaster emergency headquarters every day. When necessary, the county natural disaster emergency headquarters organizes experts to conduct real-time disaster situation, development trend of disaster situation and needs assessment of the affected areas.

(4) According to the application of the disaster-stricken areas and the verification of the disaster situation by the county emergency bureau in conjunction with relevant departments, the county finance bureau in conjunction with the county emergency bureau and other relevant departments timely allocated county-level natural disaster relief funds to support the natural disaster relief work. The county emergency bureau shall, jointly with the county commerce commission, urgently allocate life-saving relief materials, guide and supervise the implementation of emergency measures for grassroots disaster relief and the distribution of disaster relief funds and materials. County Transportation Bureau coordinates and guides the transportation of relief materials and personnel.

(5) The county public security bureau strengthens social security and road traffic emergency management in the disaster-stricken areas, and assists the disaster-stricken areas to transfer the affected people. According to the needs of the disaster task, the county fire rescue brigade participated in the disaster relief work in time and strengthened the fire management of resettlement places. The People’s Armed Forces Department of the county and the Armed Police Squadron of the county shall, at the request of the county government, organize and coordinate the armed police, militia and reserve forces to participate in disaster relief, and assist the disaster-stricken areas in transporting and distributing relief materials when necessary.

(6) The county development and reform commission, the county agricultural and rural commission, the county commerce commission and other departments shall, in accordance with the division of responsibilities and market demand, organize to increase the production, processing and supply of daily necessities, conduct market inspections, and ensure that the market supply and prices are relatively stable. County communication operation enterprises should do a good job in emergency communication support. County Economic Information Committee organizes and coordinates the production and supply of disaster relief equipment, protection and disinfection supplies, medicines, etc. County Housing and Urban-Rural Construction Committee guides the safety emergency assessment of post-disaster housing construction and municipal infrastructure projects. The county water conservancy bureau guides the restoration of water conservancy projects, water supply in the water conservancy industry and emergency water supply in the affected areas. County Health and Wellness Committee timely organized medical teams to assist in medical treatment, post-disaster epidemic prevention and psychological assistance in disaster-stricken areas. County Economic Information Committee provides comprehensive advice on science and technology, coordinates scientific and technological achievements applicable to disaster relief and supports disaster relief work. County Planning and Natural Resources Bureau prepares geographic information data of disaster-stricken areas, organizes emergency mapping such as on-site image acquisition of disaster-stricken areas, carries out disaster monitoring and spatial analysis, and provides emergency mapping support services. The County Bureau of Ecology and Environment organizes emergency monitoring on the scene of environmental emergencies and surrounding areas, puts forward requirements or suggestions to prevent the situation from expanding and control pollution, and gives guidance on the removal of pollutants at the scene of accidents, the safe transfer of radioactive sources and the restoration of ecological environment.

(7) The Propaganda Department of the county party committee shall make overall plans for news propaganda and public opinion guidance.

(8) The County Emergency Bureau, together with the County Civil Affairs Bureau, announced the acceptance of disaster relief donations to the public, organized disaster relief donation activities, uniformly received, managed and distributed disaster relief donations, and guided social organizations, volunteers and other social forces to participate in disaster relief work in an orderly manner. County charities and county red cross societies carry out disaster relief fund-raising activities according to law and participate in disaster relief work.

(9) After the disaster situation is stable, according to the relevant deployment of the county government on disaster assessment, the county emergency bureau, relevant member units and affected towns (streets) organize comprehensive assessment of natural disaster losses. The office of the county natural disaster emergency headquarters issued a unified release of natural disaster losses in accordance with relevant regulations.

(10) Other member units of the County Disaster Reduction Committee shall, in accordance with the division of responsibilities, do a good job in relevant work.

5.2 Level II response

5.2.1 Starting conditions

A major natural disaster occurs within the administrative area of Chengkou County, and if one of the following circumstances occurs during a disaster, a level II response will be initiated:

(1) More than 5 people and less than 10 people died;

(2) more than 1,500 people and less than 2,000 people who need emergency resettlement or emergency life assistance;

(3) More than 500 houses and less than 1,000 houses collapsed and seriously damaged;

(4) Drought disasters have caused difficulties in life such as lack of food or water, and the number of people who need government assistance is more than 2,000 and less than 3,000;

(5) The county natural disaster emergency headquarters considers other situations that meet the requirements for starting level II response and other special emergency plans for natural disasters.

5.2.2 Start-up procedure

After the disaster, the office of the county natural disaster emergency headquarters determined that the disaster reached the start-up standard after analysis and evaluation, and put forward suggestions to the county natural disaster emergency headquarters to start the level II response; The executive deputy commander-in-chief of the county natural disaster emergency headquarters decided to start the level II response and report to the commander-in-chief of the county natural disaster emergency headquarters.

5.2.3 Response measures

The executive deputy commander-in-chief of the county natural disaster emergency headquarters or the deputy commander-in-chief of the county natural disaster emergency headquarters (deputy magistrate in charge of production safety) shall organize and lead the natural disaster relief work at the county level, and guide and support the natural disaster relief work in the affected areas. The county natural disaster emergency headquarters and its member units shall take the following measures as appropriate:

(1) The executive deputy commander-in-chief of the county natural disaster emergency headquarters or the deputy commander-in-chief appointed by the county natural disaster emergency headquarters (deputy magistrate in charge of production safety) presided over a meeting of the Chamber of Commerce, with the participation of all member units, expert groups and relevant affected areas, to analyze the situation in the affected areas and study and implement disaster relief support measures for the affected areas.

(2) the executive deputy commander-in-chief of the county natural disaster emergency headquarters or the deputy commander-in-chief of the county natural disaster emergency headquarters (deputy magistrate in charge of production safety) led the relevant member units to the disaster-stricken areas to guide the natural disaster relief work; According to the development of the disaster situation, the director of the county emergency bureau led an early working group composed of relevant member units to visit the affected people, verify the disaster situation and guide the disaster relief work in the affected areas.

(3) The county emergency bureau timely grasps the dynamic information of the disaster situation and disaster relief work, organizes disaster consultation, and timely releases the needs of the affected areas. Relevant member units should share information about the disaster situation, the needs of the affected areas and the dynamics of disaster relief work, and report the relevant information to the office of the county natural disaster emergency headquarters every day. When necessary, the county natural disaster emergency headquarters organizes experts to conduct real-time disaster situation, development trend of disaster situation and needs assessment of the affected areas.

(4) According to the application of the affected villages and towns (streets) and the verification of the disaster by the county emergency bureau in conjunction with relevant departments, the county finance bureau in conjunction with the county emergency bureau and other relevant departments timely allocated natural disaster relief funds to support the natural disaster relief work. The county emergency bureau shall, jointly with the county commerce commission, urgently allocate life-saving relief materials, guide and supervise the grassroots to implement emergency measures for disaster relief and distribute disaster relief funds and materials; County Transportation Bureau coordinates and guides the transportation of relief materials and personnel.

(5) The county public security bureau strengthens social security and road traffic emergency management in the disaster-stricken areas, and assists the disaster-stricken areas to transfer the affected people. According to the needs of the disaster task, the county fire rescue brigade participated in the disaster relief work in time and strengthened the fire management of resettlement places. The People’s Armed Forces Department of the county and the Armed Police Squadron of the county shall, at the request of the county government, organize and coordinate the armed police, militia and reserve forces to participate in disaster relief, and assist the disaster-stricken areas in transporting and distributing relief materials when necessary.

(6) The county development and reform commission, the county agricultural and rural commission, the county commerce commission and other departments shall, in accordance with the division of responsibilities and market demand, organize to increase the production, processing and supply of daily necessities, conduct market inspections, and ensure that the market supply and prices are relatively stable. County communication operation enterprises should do a good job in emergency communication support. County Economic Information Committee organizes and coordinates the production and supply of disaster relief equipment, protection and disinfection supplies, medicines, etc. County Housing and Urban-Rural Construction Committee guides the safety emergency assessment of post-disaster housing construction and municipal infrastructure projects. The county water conservancy bureau guides the restoration of water conservancy projects, water supply in the water conservancy industry and emergency water supply in the affected areas. County Health and Wellness Committee timely organized medical teams to assist in medical treatment, post-disaster epidemic prevention and psychological assistance in disaster-stricken areas. County Economic Information Committee provides comprehensive advice on science and technology, coordinates scientific and technological achievements applicable to disaster relief and supports disaster relief work. County Planning and Natural Resources Bureau prepares geographic information data of disaster-stricken areas, organizes emergency mapping such as on-site image acquisition of disaster-stricken areas, carries out disaster monitoring and spatial analysis, and provides emergency mapping support services. The County Bureau of Ecology and Environment organizes emergency monitoring on the scene of environmental emergencies and surrounding areas, puts forward requirements or suggestions to prevent the situation from expanding and control pollution, and gives guidance on the removal of pollutants at the scene of accidents, the safe transfer of radioactive sources and the restoration of ecological environment.

(7) The Propaganda Department of the county party committee shall make overall plans for news propaganda and public opinion guidance.

(8) The County Emergency Bureau, together with the County Civil Affairs Bureau, announced the acceptance of disaster relief donations to the public, organized disaster relief donation activities, uniformly received, managed and distributed disaster relief donations, and guided social organizations, volunteers and other social forces to participate in disaster relief work in an orderly manner. County charities and county red cross societies carry out disaster relief fund-raising activities according to law and participate in disaster relief work.

(9) After the disaster situation is stable, according to the relevant deployment of the county government on disaster assessment, the county emergency bureau, relevant member units and affected towns (streets) organize comprehensive assessment of natural disaster losses. The office of the county natural disaster emergency headquarters issued a unified release of natural disaster losses in accordance with relevant regulations.

(10) Other member units of the County Disaster Reduction Committee shall, in accordance with the division of responsibilities, do a good job in relevant work.

5.3 Class III response

5.3.1 Starting conditions

A major natural disaster occurs within the administrative area of Chengkou County, and if one of the following circumstances occurs during a disaster, a Class III response will be initiated:

(1) More than 3 people and less than 5 people died;

(2) more than 1,000 people and less than 1,500 people need emergency resettlement or emergency life assistance;

(3) More than 300 houses and less than 500 houses collapsed and seriously damaged;

(4) The drought disaster causes food shortage or water shortage, and the number of people who need government assistance is more than 1,000 and less than 2,000;

(5) The county natural disaster emergency headquarters considers other situations that meet the requirements for starting level III response and other special emergency plans for natural disasters.

5.3.2 Startup procedure

After the disaster, the office of the county natural disaster emergency headquarters determined that the disaster reached the starting conditions after analysis and evaluation, and the deputy commander of the county natural disaster emergency headquarters (in charge of the deputy county magistrate) decided to start the level III response.

5.3.3 Response measures

Director of the office of the county natural disaster emergency headquarters (director of the county emergency bureau) or appointed deputy director of the county emergency bureau to organize and coordinate the natural disaster relief work at the county level, and guide and support the natural disaster relief work in the affected areas. The county natural disaster emergency headquarters and its member units shall take the following measures as appropriate:

(1) The director of the office of the county natural disaster emergency headquarters (the director of the county emergency bureau) or the deputy director in charge of the county emergency bureau shall promptly organize relevant member units and the affected areas to hold meetings and chambers of commerce, analyze the situation in the affected areas, and study and implement the disaster relief support measures for the affected areas.

(2) The director of the office of the county natural disaster emergency headquarters (the director of the county emergency bureau) or a joint working group led by the deputy director in charge of the county emergency bureau and attended by relevant member units went to the affected areas to express condolences to the affected people, verify the disaster situation and guide the disaster relief work in the affected areas.

(3) The office of the county natural disaster emergency headquarters timely grasps and uniformly releases the dynamic information of disaster situation and disaster relief work in accordance with relevant regulations.

(4) According to the application of the affected areas and the verification of the disaster situation, the County Finance Bureau and the County Emergency Bureau timely allocate natural disaster relief funds to support the natural disaster relief work. The county emergency bureau and the county commerce commission urgently allocate life-style relief materials, guide and supervise the disaster-stricken areas to implement emergency measures for disaster relief and distribute relief funds and materials; County Transportation Bureau coordinates and guides the transportation of relief materials and personnel.

(5) The county public security bureau guides the affected areas to strengthen social security and road traffic emergency management, and assists the affected areas to transfer the affected people. According to the needs of the disaster task, the county fire rescue brigade participated in the disaster relief work in time and strengthened the fire management of resettlement places. The People’s Armed Forces Department of the county and the Armed Police Squadron of the county shall, at the request of the county government, organize and coordinate the armed police, militia and reserve forces to participate in disaster relief, and assist the disaster-stricken areas in transporting and distributing relief materials when necessary.

(6) The county development and reform commission, the county agricultural and rural commission, the county commerce commission and other departments shall, in accordance with the division of responsibilities and market demand, guide the organizations in the affected areas to increase the production, processing and supply of daily necessities, conduct market inspections, ensure market supply, and prevent price fluctuations. County communication operation enterprises should do a good job in emergency communication support for disaster-stricken areas. The County Economic Information Committee guides the disaster-stricken areas to organize and coordinate the production and supply of disaster relief equipment, protection and disinfection supplies, medicines, etc. County Housing and Urban-Rural Construction Committee guides the disaster-stricken areas to do a good job in housing construction and municipal infrastructure project loss assessment. County Water Conservancy Bureau guides the restoration of water conservancy projects in the affected areas, water supply in the water conservancy industry and emergency water supply in the affected towns (streets). The County Health and Wellness Committee guides the medical and health teams in the disaster-stricken areas to carry out health emergency work such as medical treatment, post-disaster epidemic prevention and psychological assistance. County Economic Information Committee guides the disaster-stricken areas to provide comprehensive scientific and technological advice, and coordinates scientific and technological achievements applicable to disaster relief in the disaster-stricken areas to support disaster relief work. County Planning and Natural Resources Bureau guides the disaster-stricken areas to prepare geographic information data of the disaster-stricken areas, organizes emergency mapping such as on-site image acquisition of the disaster-stricken areas, carries out disaster monitoring and spatial analysis, and provides emergency mapping support services. The County Bureau of Ecology and Environment guides the disaster-stricken areas to do a good job in environmental emergency monitoring at the scene of sudden environmental incidents and surrounding areas, puts forward requirements or suggestions for preventing the situation from expanding and controlling pollution, and gives guidance on the removal of pollutants at the accident site, the safe transfer of radioactive sources and the restoration of the ecological environment.

(7) The Propaganda Department of the County Party Committee guides the disaster-stricken areas to do a good job in news propaganda and public opinion guidance.

(8) The county emergency bureau and the county civil affairs bureau shall guide social organizations, volunteers and other social forces to participate in disaster relief work in an orderly manner.

(9) After the disaster situation is stable, the relevant member units of the county natural disaster emergency headquarters shall guide the disaster-stricken areas to organize comprehensive disaster loss assessment. The office of the county natural disaster emergency headquarters issued a unified release of natural disaster losses in accordance with relevant regulations.

(10) Other member units of the county natural disaster emergency headquarters shall, in accordance with the division of responsibilities, do a good job in relevant work.

5.4 Class IV response

5.4.1 Starting conditions

A general natural disaster occurs within the administrative area of Chengkou County, and if one of the following circumstances occurs during a disaster, a level IV response will be initiated:

(1) More than 1 person and less than 3 people died;

(2) more than 500 people and less than 1,000 people need emergency resettlement and emergency life assistance;

(3) More than 100 houses and less than 300 houses collapsed and seriously damaged;

(4) The drought disaster causes food shortage or water shortage, and the number of people who need government assistance is more than 100 and less than 1,000;

(5) The county natural disaster emergency headquarters considers that other situations meet the requirements for starting the level IV response and other special natural disaster emergency plans meet the conditions for starting the level IV response.

5.4.2 Start-up procedure

After the disaster, the office of the county natural disaster emergency headquarters determined that the disaster reached the starting standard after analysis and evaluation, and the director of the office of the county natural disaster emergency headquarters (the director of the county emergency bureau) decided to start the level IV response.

5.4.3 Response measures

Deputy Director of the County Emergency Bureau or appointed relevant responsible comrades to organize and coordinate the natural disaster relief work at the county level, and guide and support the natural disaster relief work in the affected areas. The county natural disaster emergency headquarters and its member units shall take the following measures as appropriate:

(1) The deputy director in charge of the county emergency bureau or appoint relevant responsible comrades to organize relevant member units to hold meetings and chambers of commerce in time, analyze the situation in the affected areas, and study and implement disaster relief support measures in the affected areas.

(2) The deputy director in charge of the county emergency bureau or appoint relevant responsible comrades to lead a team to the affected areas to express condolences to the affected people, verify the disaster situation and guide the disaster relief work in the affected areas.

(3) The office of the county natural disaster emergency headquarters timely grasps and uniformly releases the dynamic information of disaster situation and disaster relief work in accordance with relevant regulations.

(4) According to the application of the affected areas and the verification of the disaster situation, the County Finance Bureau and the County Emergency Bureau timely allocate natural disaster relief funds to support the natural disaster relief work. The county emergency bureau and the county commerce commission urgently allocate domestic relief materials, guide and supervise the disaster-stricken areas to implement emergency measures for disaster relief and distribute relief funds and materials.

(5) The county public security bureau guides the affected areas to strengthen social security and road traffic emergency management, and assists the affected areas to transfer the affected people. According to the needs of the disaster task, the county fire rescue brigade participated in the disaster relief work in time and strengthened the fire management of resettlement places. The People’s Armed Forces Department of the county and the Armed Police Squadron of the county shall, at the request of the county government, organize and coordinate the armed police, militia and reserve forces to participate in disaster relief, and assist the disaster-stricken areas in transporting and distributing relief materials when necessary.

(6) The county development and reform commission, the county agricultural and rural commission, the county commerce commission and other departments shall, in accordance with the division of responsibilities and market demand, guide the organizations in the affected areas to increase the production, processing and supply of daily necessities, conduct market inspections, ensure market supply, and prevent price fluctuations. County communication operation enterprises should do a good job in emergency communication support for disaster-stricken areas. The County Economic Information Committee guides the disaster-stricken areas to organize and coordinate the production and supply of disaster relief equipment, protection and disinfection supplies, medicines, etc. County Housing and Urban-Rural Construction Committee guides the disaster-stricken areas to do a good job in housing construction and municipal infrastructure project loss assessment. County Water Conservancy Bureau guides the restoration of water conservancy projects in the affected areas, water supply in the water conservancy industry and emergency water supply in the affected towns (streets). The County Health and Wellness Committee guides the medical and health teams in the disaster-stricken areas to carry out health emergency work such as medical treatment, post-disaster epidemic prevention and psychological assistance. County Economic Information Committee guides the disaster-stricken areas to provide comprehensive scientific and technological advice, and coordinates scientific and technological achievements applicable to disaster relief in the disaster-stricken areas to support disaster relief work. County Planning and Natural Resources Bureau guides the disaster-stricken areas to prepare geographic information data of the disaster-stricken areas, organizes emergency mapping such as on-site image acquisition of the disaster-stricken areas, carries out disaster monitoring and spatial analysis, and provides emergency mapping support services. The County Bureau of Ecology and Environment guides the disaster-stricken areas to do a good job in environmental emergency monitoring at the scene of sudden environmental incidents and surrounding areas, puts forward requirements or suggestions for preventing the situation from expanding and controlling pollution, and gives guidance on the removal of pollutants at the accident site, the safe transfer of radioactive sources and the restoration of the ecological environment.

(7) The Propaganda Department of the County Party Committee guides the disaster-stricken areas to do a good job in news propaganda and public opinion guidance.

(8) The county emergency bureau and the county civil affairs bureau shall guide social organizations, volunteers and other social forces to participate in disaster relief work in an orderly manner.

(9) After the disaster situation is stable, the relevant member units of the county natural disaster emergency headquarters shall guide the disaster-stricken areas to organize comprehensive disaster loss assessment. The office of the county natural disaster emergency headquarters issued a unified release of natural disaster losses in accordance with relevant regulations.

(10) Other member units of the county natural disaster emergency headquarters shall, in accordance with the division of responsibilities, do a good job in relevant work.

5.5 Adjustment of startup conditions

When the disaster occurs in sensitive areas, areas with particularly weak sensitive time and rescue ability, or when the disaster has a significant impact on the economy and society of the affected areas, the criteria for starting the emergency response of county natural disaster relief can be adjusted as appropriate.

5.6 Response Termination

After the disaster relief and emergency work, the office of the county natural disaster emergency headquarters put forward suggestions, and the agency that initiated the response decided to terminate the response.

six Disaster relief

6.1 transitional life assistance

6.1.1 After the occurrence of natural disasters, the county emergency bureau shall guide the affected towns (streets) to timely assess the needs of life assistance in the disaster-stricken areas during the transition period.

6.1.2 County Finance Bureau and County Emergency Bureau shall timely allocate transitional life assistance funds. County emergency bureau to guide the affected towns (streets) to do a good job in the transition period of life assistance personnel approval, funding and other work.

6.1.3 The county emergency bureau and the county finance bureau shall supervise and inspect the implementation of policies and measures for life assistance in the disaster areas during the transitional period, regularly report the relief work in the disaster areas, and organize performance evaluation after the end of life assistance in the transitional period.

6.2 Restoration and reconstruction of damaged houses

The restoration and reconstruction of damaged houses due to disasters should respect the wishes of the masses, and the affected households should build their own houses, and the towns (streets) should be responsible for organizing the implementation. Housing funds are solved through various channels such as government assistance, social mutual assistance, neighborhood helpers, work-for-relief, self-lending, preferential policies, etc. Centralized reconstruction of construction projects should implement "unified planning, unified design, unified supporting, unified appearance", adjust measures to local conditions, rational layout, scientific planning, and fully consider the requirements of disaster prevention and mitigation; Reconstruction planning and housing design should determine the scheme according to local conditions, scientifically arrange the site selection of the project, rationally arrange the layout, avoid earthquake fault zones, hidden danger points of geological disasters, flood discharge channels, etc., improve the ability of disaster resistance and ensure safety.

6.2.1 County Emergency Bureau shall, according to the approved situation of damaged houses in villages and towns (streets), organize an assessment team as appropriate, refer to the assessment data of other disaster management departments, and conduct a comprehensive assessment of damaged houses due to disasters by means of on-the-spot investigation and sampling survey.

6.2.2 After receiving the application for subsidy funds for the restoration and reconstruction of damaged houses in villages and towns (streets), the county emergency bureau puts forward suggestions for financial subsidies according to the evaluation results of damaged houses by the evaluation team and the subsidy standards for the restoration and reconstruction of damaged houses in Chengkou County, which are issued by the county finance bureau.

6.2.3 After the restoration and reconstruction of damaged houses due to disasters, the county emergency bureau shall conduct performance evaluation on the management of subsidy funds for restoration and reconstruction of damaged houses within its administrative area by means of on-the-spot investigation and sampling investigation, and report the evaluation results to the municipal emergency bureau.

6.2.4 County Housing and Urban-Rural Construction Committee is responsible for technical support and quality supervision of damaged housing restoration and reconstruction. County Planning and Natural Resources Bureau is responsible for the surveying and mapping geographic information support service for post-disaster recovery and reconstruction. Other relevant departments shall, in accordance with their respective responsibilities, do a good job in reconstruction planning and site selection, formulate preferential policies, and support the restoration and reconstruction of damaged houses.

6.2.5 The restoration and reconstruction organized by the office of the county natural disaster emergency headquarters shall be carried out in accordance with relevant regulations.

6.3 winter and spring assistance

In the winter of the year and the spring of the following year after natural disasters, the affected towns (streets) provide basic living assistance for the affected people with difficulties in life.

6.3.1 The affected villages and towns (streets) shall, starting from the first ten days of September each year, investigate, verify, summarize and evaluate the basic living assistance needs of the affected people in their respective administrative areas in the winter of that year and the spring of the following year, verify the assistance objects, prepare work ledgers, formulate rescue work plans, organize and implement them in time, and report them to the county emergency bureau for the record.

6.3.2 County Emergency Bureau conducts verification and summary of the living difficulties of the affected people in winter and spring in mid-September every year, and conducts assessment and verification of the living difficulties of the affected people in conjunction with towns (streets).

6.3.3 According to the application for money and materials of villages and towns (streets), combined with the assessment of the living difficulties of the affected people, the county emergency bureau determines the winter and spring relief materials and financial subsidy scheme, and allocates the winter and spring relief materials in time, and the county finance bureau allocates the winter and spring relief subsidy funds for natural disasters to help solve the basic living difficulties of the affected people during winter and spring, such as eating, dressing and heating.

6.3.4 The county emergency bureau solves the problems of the affected people’s winter clothes and quilts by means of disaster relief donation, counterpart support and government procurement, and organizes and evaluates the performance of the county’s mid-term and final rescue work during winter and spring. The county development and reform commission, the county finance bureau and other departments organized and implemented the policy of work-for-work relief and disaster relief. The food sector ensures food supply.

seven safeguard measure

7.1 Financial guarantee

County Finance Bureau should arrange necessary management funds in the budget at the corresponding level according to the needs of natural disaster relief work, which is mainly used for the necessary expenses such as disaster investigation and nuclear disaster, the production of original data files, and the management of disaster relief reserve materials, so as to ensure the smooth development of disaster relief work.

7.2 Material support

Accelerate the construction of a secondary disaster relief material reserve network system based on county disaster relief material reserves and supported by township (street) disaster relief material reserves. Improve the storage facilities and functions of disaster relief materials, improve the agreement storage mechanism, and reasonably store necessary disaster relief materials such as tents, clothes, cot, food and drinking water; Improve the emergency procurement and transportation mechanism of relief materials to ensure that relief materials are delivered to the disaster areas safely, quickly and orderly.

7.3 Communication and information guarantee

The office of the county natural disaster emergency headquarters took the lead in establishing a disaster information sharing platform for the interconnection of county natural disaster relief member units and townships (streets), and improved the information sharing mechanism. Each member unit of the office of the county natural disaster emergency headquarters shall determine a liaison officer to maintain 24-hour communication during the disaster emergency response. Cooperate with the Municipal Emergency Bureau to establish an interconnected disaster management platform and gradually extend it to towns (streets).

7.4 Equipment and equipment support

The relevant departments and units of the county government should be equipped with the necessary equipment and equipment for emergency relief work. We should establish and improve the technical support system for emergency command of natural disaster relief, and provide necessary transportation, communication and other equipment for natural disaster relief.

7.5 Human resources protection

The office of the county natural disaster emergency headquarters shall, jointly with the county economic information commission, the county agricultural and rural commission, the county emergency bureau, the county meteorological bureau, the county water conservancy bureau, the county planning natural resources bureau and other departments, strengthen the construction of various professional rescue teams for natural disasters. The county emergency bureau organized the training of disaster information officers and carried out the professional qualification certification, and established a team of disaster information officers covering counties, departments, towns (streets) and villages (residential areas). Give full play to the role of relevant social organizations and volunteer teams.

7.6 Social mobilization guarantee

We will improve the policies related to the management of disaster relief donations, establish and improve the mobilization, operation, supervision and management mechanism of disaster relief donations, and standardize the work of all aspects of disaster relief donations, such as organization and launch, receipt, statistics, distribution, use, publicity and feedback.

7.7 Publicity, training and drills

7.7.1 Publicity on disaster prevention and mitigation

County natural disaster emergency headquarters office and its member units and towns (streets) should organize activities such as "Disaster Prevention and Mitigation Day" and "International Disaster Reduction Day", vigorously publicize natural disaster emergency laws and regulations and knowledge of prevention, hedging, self-help and mutual rescue, and improve public awareness and skills of disaster prevention and mitigation. Education on disaster prevention and mitigation is widely carried out in primary and secondary schools and vocational schools throughout the county to cultivate students’ awareness of disaster prevention and mitigation.

7.7.2 preplan training

The office of the county natural disaster emergency headquarters and its member units shall, according to the requirements of this emergency plan, formulate corresponding emergency plans, reserve necessary emergency materials, organize relevant personnel to carry out business training, be familiar with the working procedures and requirements for implementing the plan, and make all the preparations for implementing the plan.

7.7.3 drill

The office of the county natural disaster emergency headquarters and its member units should regularly organize natural disaster emergency rescue drills, train emergency teams, implement post responsibilities, master relevant skills, and improve emergency response capabilities.

eight supplementary provisions

8.1 Interpretation of Terms

The natural disasters mentioned in this plan mainly include meteorological disasters such as drought, flood, wind and hail, low temperature freezing, rain and snow, geological disasters such as earthquake, mountain collapse, landslide and debris flow, forest and grassland fires and major biological disasters.

In the quantitative expression of this plan, "above" includes the number, and "below" does not include the number.

8.2 Plan management