In a corner of the National Museum of Sri Lanka, an ancient monument inscribed with Chinese characters, Tamil and Persian stands quietly.

It was Zheng He, a navigator from China, who brought this stone tablet to Sri Lanka. At the beginning of the 15th century, Zheng He led "tens of thousands of people in more than 100 giant ships" and arrived here for several months to exchange and barter with local people, and presented stone tablets as a gesture of friendship.

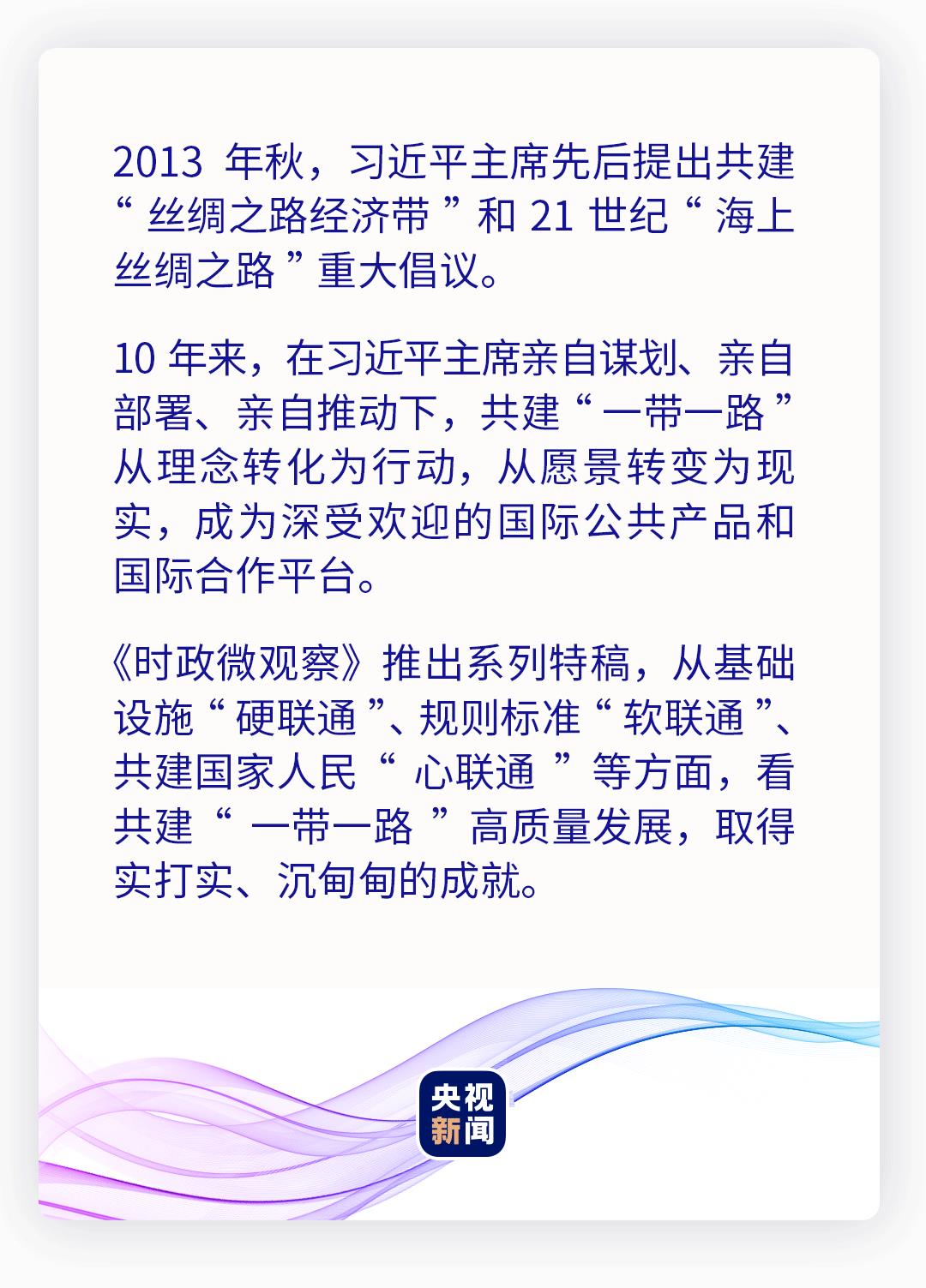

In 2013, after the Chairman of the Supreme Leader proposed to jointly build the Belt and Road Initiative, Sri Lanka was the first country to support it in the form of a government statement.

The turn of the country lies in the blind date between the people. On September 7, 2013, the Chairman of the Supreme Leader pointed out in his speech in Kazakhstan that to do a good job in cooperation in the fields of policies, facilities, trade and capital, "we must get the support of people from all countries, strengthen people’s friendly exchanges, enhance mutual understanding and traditional friendship, and lay a solid public opinion foundation and social foundation for regional cooperation."

People’s blind date lies in empathy. People’s hearts are connected, which is the most basic, solid and lasting interconnection. In the past 10 years, one project has blossomed in the country of building the "Belt and Road", which has brought the hearts of people of all countries closer.

"Small but beautiful" livelihood project

"TV is like another pair of my eyes, which makes me see the outside world at once. It turns out that the world is so big and there are so many interesting things!" A 9-year-old Nigerian boy said. Thanks to China’s "Universal Village Access" project, many African villagers have taken a fancy to digital TV with stable signal and rich content.

The "Universal Village Access" project aims to connect 10,000 villages in Africa with satellite digital TV signals. It is a livelihood project in the plan to strengthen China-Africa humanities cooperation proposed by the Chairman of the Supreme Leader at the Johannesburg Summit of the Forum on China-Africa Cooperation in 2015.

△ In July, 2023, children of Picoco Village School in maputo province stood in front of a house equipped with a satellite TV receiving antenna aided by China.

"People’s livelihood project is an important way to quickly improve the sense of gain of the people who build a country together, and it is immediate." On November 19, 2021, at the third symposium on the construction of the Belt and Road, General Secretary of the Supreme Leader pointed out that "small and beautiful projects directly affect the people. In the future, we should make small and beautiful projects a priority for foreign cooperation, strengthen overall planning, give full play to the role of foreign aid funds, and form more projects that are grounded and gather people’s hearts. "

In Cambodia, China helped 16 provinces to build more than 1,800 deep wells and nearly 130 community ponds, effectively solving the shortage of drinking water sources and water sanitation problems of local rural residents;

In Samoa, a Pacific island country, China’s agricultural technical assistance project aided the construction of comprehensive demonstration farms and other agricultural extension systems, and accumulated tens of thousands of trainings;

In Zambia, solar mills provide people with enough corn flour to increase the added value of local agricultural products;

In Papua New Guinea, fungus grass has become the local rich grass … …

△ On December 17th, 2020, in East Highland Province, Papua New Guinea, local people who participated in the 9th training course of China’s technical project of assisting Papua New Guinea’s grass and upland rice showed their certificates of completion.

The projects of "small but beautiful" and "practical and beneficial" have been implemented steadily, helping the people of the country to increase their income and improve their lives. For the people who build the country together, the "Belt and Road" proposed by China is concrete and tangible — — It is water and electricity, roads and bridges, schools and hospitals, and it is a rich salary and a promising tomorrow.

"Now, you can drive to different parts of Uganda on asphalt roads, and most of these roads are built by China enterprises." Richard Taodewang, general secretary of Uganda’s ruling National Resistance Movement, said that the joint construction of the "Belt and Road" has promoted the connectivity and development of the country and has been welcomed by local people. This is the attraction of the joint construction of the "Belt and Road".

Build a monument of friendship

On the eve of International Children’s Day on June 1st this year, the Chairman of the Supreme Leader wrote back to Alifa Qin, a Bangladeshi child, encouraging her to study hard, pursue her dreams and inherit the traditional friendship between China and Bangladesh.

"Chin", which means "China" in Mongolian, has a touching story behind the name.

Arifa Qin was born in 2010. When she was born, her mother Janet suffered dystocia because of severe heart disease, and her life was dying for a time. At that time, it was the first time that China Navy’s hospital ship "Square Boat" carried out the "harmonious mission" in Bangladesh. After receiving help, the hospital ship rushed to the local hospital at the first time.

After two hours of surgery, Janet finally gave birth to a baby girl. Looking at his daughter, who weighs only 3 kg, and his wife, who has just been pulled back from death, the child’s father specially named his daughter Qin "Chin" to express his gratitude to the soldiers in China. He said that his daughter should remember China and her savior.

△ On August 22nd, 2013, Arifa Qin was with the nurse from China who had taken care of her in 2010.

"Qin’s personal experience in the letter is a vivid portrayal of China-Bangladesh friendship." In his reply to Qin, the Chairman of the Supreme Leader said, "China and Bangladeshi people have been good neighbors and friends since ancient times, and have a history of friendly exchanges stretching back thousands of years."

Millennium friendship has been passed down from generation to generation, and pragmatic cooperation has been promoted step by step.

In October 2016, the Chairman of the Supreme Leader made a historic visit to Bangladesh, and China-Bangladesh relations were upgraded to a strategic partnership. Bangladesh is the first country in South Asia to sign a memorandum of understanding with China to jointly build the Belt and Road Initiative.

Today, in the face of endless global challenges, the Chairman of the Supreme Leader has a profound insight: "I propose to build a community of human destiny and propose to build together ‘ Belt and Road ’ It is to repeatedly think about how countries around the world should achieve mutual cooperation, sharing, harmony without differences, and win-win cooperation in diverse interests and demands. "

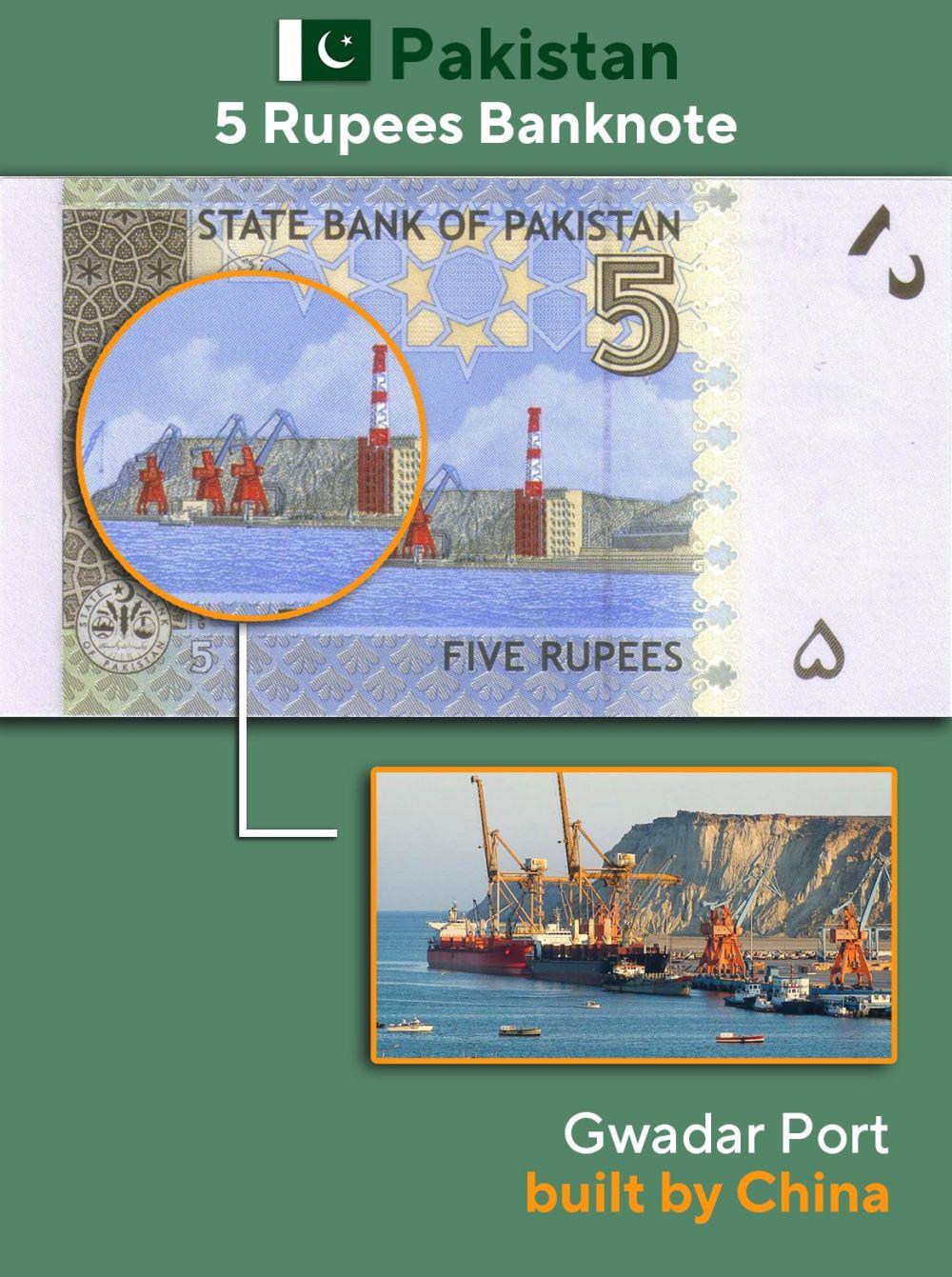

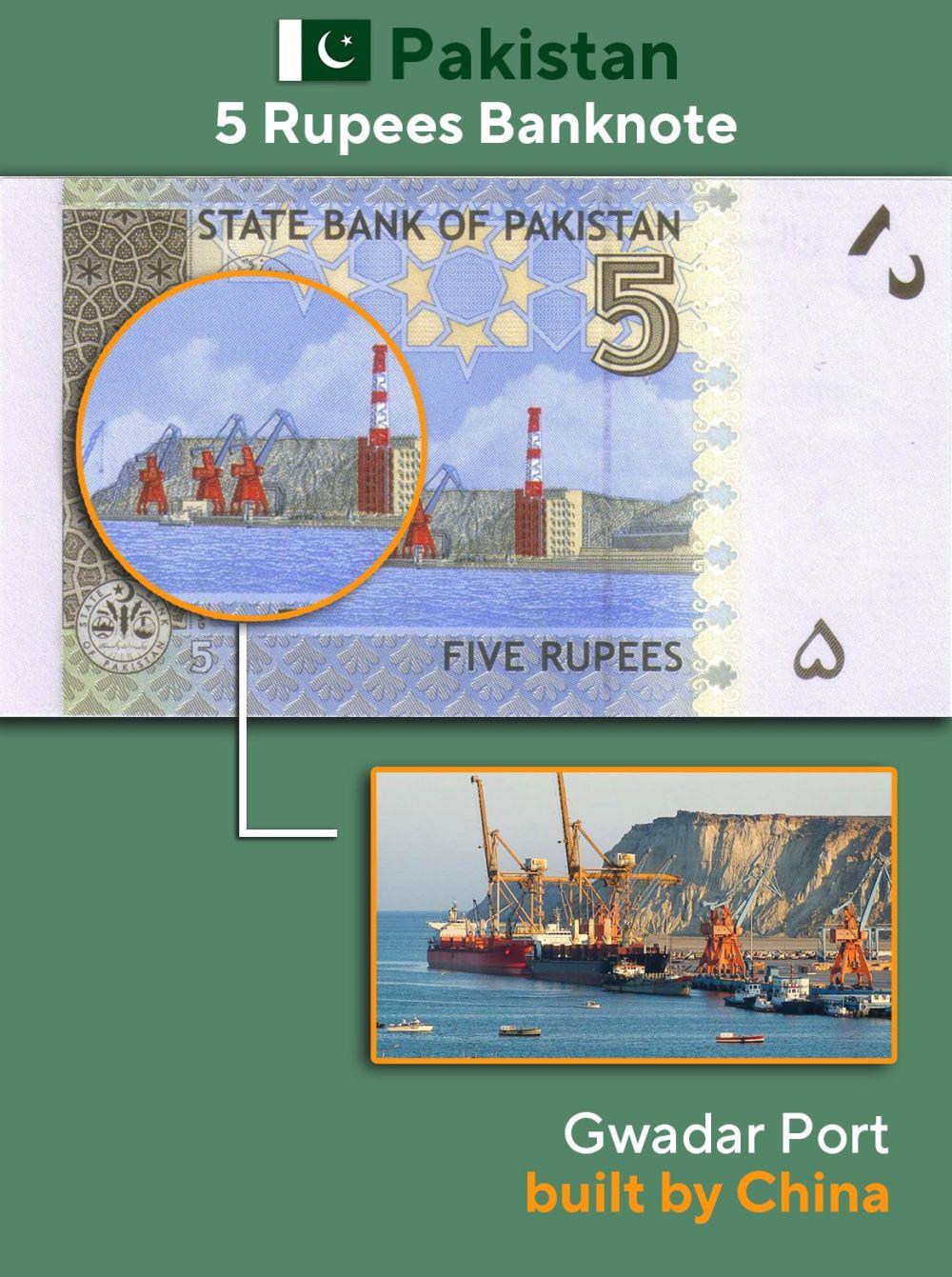

In Pakistan, Gwadar Port is the flagship project of China-Pakistan "Belt and Road" cooperation and a new milestone of China-Pakistan friendship in the 21st century. At present, projects such as Gwadar Port Free Zone and China-Pakistan Friendship Hospital have been completed or under construction. The solar power generation system and equipment donated by China to Gwadar people have promoted local economic and social development.

△ Gwadar Port is printed on Pakistani banknotes with a denomination of 5 rupees.

"Where the project is built, a monument of friendship will be built there", in December 2018, when the Chairman of the Supreme Leader visited Panama for the first time, he exclaimed. Today, large-scale projects full of China elements, such as the Fourth Panama Canal Bridge and Panama National Convention and Exhibition Center, have become local landmarks, and China commodities are increasingly integrated into people’s daily lives. Eddie Tabiro, an expert on financial strategy of Panama Canal Authority, said with emotion: "‘ Belt and Road ’ Cooperation is not who conquers who, but mutual help between friends. "

Get to know each other in the encounter, work together in the mutual understanding, and build the "Belt and Road". People are hand in hand and jointly build a beautiful home.

Humanistic exchange of mutual learning and learning

At the end of September this year, Beijing Capital International Airport welcomed more than 30 students from Thailand. In the next year, these students will enter Tianjin Bohai Vocational and Technical College to study vocational education courses in China.

Letting Thai students go to China to receive vocational education in China is the first cooperation between Tianjin Bohai Vocational and Technical College and Thailand Dacheng Technical College after the initiative of jointly building the Belt and Road Initiative, named after Luban, a famous craftsman in ancient China.

There is no Luban in Luban Workshop, but there are more than 70 professional skills courses such as industrial robots, new energy and Internet of Things. In September 2018, the Chairman of the Supreme Leader solemnly announced at the Beijing Summit of the Forum on China-Africa Cooperation that China would "set up 10 Luban workshops in Africa to provide vocational skills training for African youth".

△ Djibouti Luban Workshop

Osman, a young man from Djibouti, had a "railway dream" since he was a child. I heard that Luban Workshop in Djibouti is recruiting students majoring in railway, and he will sign up immediately. "My family condition is particularly bad. Can I be admitted to Luban Workshop?" During the interview, Osman expressed his concern. The interviewer in China said, "I believe you. If you work hard, you can also become the Luban of Djibouti." After layers of selection, Osman became one of the first batch of 24 freshmen and will directly participate in the construction of Yaji Railway in the future.

"Really want to build ‘ Belt and Road ’ It is necessary to form a humanistic pattern of mutual appreciation, mutual understanding and mutual respect among the people along the route. " General Secretary of the Supreme Leader said.

Promote the "Belt and Road" cultural and tourism exchanges, implement the "Cultural Silk Road" plan, establish an international alliance of theaters, museums, art festivals, libraries and art galleries along the Silk Road, actively co-organize art festivals, film festivals, music festivals, cultural relics exhibitions, book exhibitions and other activities with the co-construction countries, cooperate in the creation and mutual translation and broadcasting of excellent books, radio, film and television, and jointly implement the joint archaeological and cultural relics restoration project & HELIP; … In the past 10 years, the co-construction countries have extensively carried out cultural tourism cooperation, educational exchanges, cooperation between media and think tanks, and people-to-people exchanges, and promoted mutual learning and cultural integration and innovation, forming a pattern of people-to-people exchanges with multiple interactions and flowers blooming.

△ On October 6, 2023, diplomatic envoys from many countries in Kenya watched a cultural performance at Nairobi Station of Monnet Railway in Nairobi, Kenya.

Throughout the ten years since the "Belt and Road Initiative" was jointly established, China and the co-construction countries have written many stories of "casting me a peach and rewarding me with Qiong Yao". This is the inheritance of traditional virtues and the cherish of friendship by the Chinese nation for thousands of years.

This kind of treasure has nothing to do with distance — — No matter how far apart, as long as we bravely take the first step and stick to the opposite direction, we can walk out of a road of meeting and knowing each other and developing together, and move towards a happy, peaceful, harmonious and beautiful distance.

This kind of treasure is related to people’s hearts — — "We should all have the belief that people of all countries should have a better future and build together ‘ Belt and Road ’ It will definitely usher in a better world. "

There is a "road" between people.

Producer: Geng Zhimin

Producer Xing Lai

Editor-in-Chief Ning Lili

Pen-writing Yang Caiyun

Visual sense Jiang yuhang